Limit pricing is a strategic pricing approach employed by dominant firms to deter potential competitors from entering a market. It involves setting prices at a level that makes it unattractive or unprofitable for new entrants to challenge the incumbent firm’s market position.

Bain’s Model of Limit Pricing, developed by economist Joe S. Bain, provides a framework for understanding and implementing this strategic pricing strategy. Here, we will explore the key concepts and insights of Bain’s Limit Pricing theory.

See Also: What is Limit Pricing | Objectives | How It Works | Factors | Criticism

Table of Contents

ToggleIntroduction to Bain’s Limit Pricing Theory

Bain’s Model of Limit Pricing is a strategic pricing framework that aims to establish and maintain monopolistic or dominant market positions.

The primary objective is to discourage new competitors from entering the market by setting prices at a level that makes it economically unfeasible for them to operate profitably. This strategy helps the incumbent firm preserve its market share, protect its high-profit margins, and reduce competitive pressures.

Joe S. Bain: The Economist Behind the Model

Joe S. Bain, an influential economist in the mid-20th century, introduced the concept of limit pricing in his 1956 book, “Barriers to New Competition.”

Bain’s work focused on the various barriers that firms could employ to limit competition. His model laid the foundation for understanding how firms strategically employ pricing as a barrier to entry.

Theoretical Foundations of Bain’s Model of Limit Pricing

-

Market Concentration and Dominance:

Bain’s model often applies to markets characterized by high concentration ratios, where a small number of firms dominate the industry. In such markets, the dominant firm has a significant market share and can exercise market power.

-

Entry Barriers:

Central to the model is the notion of entry barriers—factors that make it difficult for new firms to enter a market. These barriers can include economies of scale, access to distribution channels, brand loyalty, and regulatory requirements.

-

The Role of Demand Elasticity:

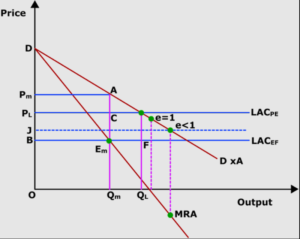

Demand elasticity, which measures how sensitive consumer demand is to price changes, plays a critical role in setting the limit price. Inelastic demand (where consumers are less responsive to price changes) allows for higher limit prices.

Determining the Limit Price:

-

Cost Structure Analysis:

Incumbent firms analyze their cost structures to identify the price at which new entrants would operate at a loss. This involves considering variable costs, fixed costs, and the level of production.

-

Pricing Below the Profitable Threshold:

The limit price is typically set just below the level at which potential competitors could cover their costs and achieve profitability. This discourages new entrants, as they would face sustained losses.

-

Anticipating Rival Responses:

Incumbent firms must also anticipate how potential rivals might respond to limit pricing. Competitors may choose to stay out of the market, challenge the limit price, or employ alternative strategies.

Limit pricing has been observed in various industries, including telecommunications, airlines, and pharmaceuticals. Incumbent firms often use this strategy to deter the entry of new, smaller competitors.

See Also: Economics PDF

Factors to Consider when Applying Bain’s Model of Limit Pricing

When applying Bain’s Model of Limit Pricing in real-world business scenarios, several key factors should be carefully considered to determine the feasibility and effectiveness of this pricing strategy:

- Market Structure: The nature of the market, including the level of competition, the presence of entry barriers, and the number of existing firms, plays a crucial role. In concentrated markets with high barriers to entry, limit pricing may be more effective.

- Cost Structure: Understanding your own cost structure is essential. Firms need to evaluate their production costs, economies of scale, and the impact of different pricing levels on profitability.

- Demand Elasticity: Analyzing the price elasticity of demand for your product is vital. If demand is relatively inelastic (insensitive to price changes), limit pricing may be more feasible as consumers are less likely to switch to competitors in response to price changes.

- Entry Threat: Assess the seriousness of potential entrants into the market. If new entrants are a significant threat, limit pricing may serve as a deterrent.

- Reputation and Brand Strength: Consider the reputation and brand strength of your firm. A strong brand may allow you to charge higher prices without losing customers

- Regulatory Environment: Be aware of industry-specific regulations and antitrust laws. Limit pricing strategies should be compliant with legal requirements.

- Long-Term vs. Short-Term Goals: Determine whether your firm’s objectives are short-term or long-term. Limit pricing may result in lower short-term profits, but it can deter new entrants and secure long-term market dominance.

- Game Theory and Strategic Behavior: Analyze how competitors are likely to respond to your pricing strategy. Understanding game theory and strategic interactions with rivals is crucial.

- Monitoring and Adaptation: Continuously monitor market conditions and the competitive landscape. Be prepared to adapt your limit pricing strategy as circumstances change.

- Exit Strategy: Consider your exit strategy if limit pricing proves unsustainable. Being prepared for different scenarios, including price wars or changing market dynamics, is essential.

- Industry-Specific Factors: Industry-specific factors, such as technological advancements, supply chain dynamics, and consumer preferences, can significantly impact the effectiveness of limit pricing.

- Bargaining Power: Evaluate the bargaining power of suppliers, distributors, and other stakeholders in the value chain, as it can influence pricing decisions.

- Customer Loyalty Programs: Implement customer loyalty programs to retain existing customers and deter potential entrants.

By carefully assessing these factors and their interplay within your industry, you can make informed decisions when applying Bain’s Model of Limit Pricing to protect your market position and achieve your strategic objectives.

Limit Pricing vs. Predatory Pricing

It’s essential to differentiate between limit pricing and predatory pricing. While both involve pricing strategies aimed at deterring competition, predatory pricing entails pricing below cost with the intent of driving competitors out of the market.

Limitations of Bain’s Model of Limit Pricing:

The limitations of Bain’s Model of Limit Pricing, like any economic model, are crucial to understanding its real-world applicability and potential shortcomings. Here are some key limitations of Bain’s Model of Limit Pricing:

- Simplifying Assumptions: The model relies on simplifying assumptions, such as perfect information, rational behavior, and static market conditions. In reality, markets are often characterized by imperfect information, dynamic changes, and various behavioral factors that can influence pricing decisions. These assumptions may not accurately capture the complexities of real-world markets.

- Difficulty in Identifying Optimal Prices: Determining the exact limit price that would effectively deter potential competitors can be challenging. It requires precise knowledge of competitors’ cost structures, demand elasticities, and strategic responses. In practice, firms may struggle to estimate these variables accurately.

- Dynamic Markets: Bain’s Model assumes static market conditions, but markets are dynamic, with factors like technological advancements, changing consumer preferences, and regulatory shifts affecting competition. Incumbent firms using limit pricing may find it difficult to maintain their dominant positions in rapidly evolving markets.

- Regulatory Scrutiny: Aggressive limit pricing strategies can attract regulatory scrutiny, especially when they result in the creation of monopolistic or dominant market positions. Antitrust authorities may investigate such behavior to ensure fair competition, potentially leading to legal challenges and penalties.

- Competitive Responses: Potential competitors may not always be discouraged by low prices. They may find innovative ways to overcome entry barriers, such as differentiating their products or offering unique services. This can reduce the effectiveness of limit pricing as a long-term strategy.

- Short-Term Focus: Limit pricing is primarily a short-term strategy aimed at deterring immediate entry. It may not be a sustainable approach for maintaining market dominance over the long term. Rival firms may patiently wait for the right conditions to enter the market or find alternative strategies to compete effectively.

- Market Structure Variations: The effectiveness of limit pricing can vary depending on the specific industry and market structure. In some industries, limit pricing may work well, while in others, it may have limited impact due to unique competitive dynamics.

- Risk of Mistaken Perceptions: Incumbent firms using limit pricing assume that potential competitors share their cost and profit calculations. If these assumptions are incorrect, the strategy may result in lost revenue or unintended competitive responses.

- Ethical Considerations: Limit pricing can raise ethical concerns, as it may involve intentionally pricing products or services at levels that harm consumers in the short term. Firms must balance their strategic goals with ethical responsibilities.

- Success Rates Vary: The success of limit pricing as a strategy can vary widely across industries and firms. While some companies may effectively deter entry, others may struggle to maintain their market positions due to unforeseen challenges.

Bain’s Model of Limit Pricing provides valuable insights into strategic pricing, but it should be applied with an awareness of its limitations. Firms considering this approach must carefully assess market conditions, regulatory environments, and competitive responses to determine its feasibility and potential effectiveness.

Bain’s Limit Pricing Theory | Determinants | Factors | Limitations | PDF Free Download |

Conclusion

Bain’s Model of Limit Pricing remains relevant in contemporary markets, particularly in industries with high concentration and significant barriers to entry. Firms continue to employ strategic pricing as a tool to deter competition.