Money market equilibrium is a foundational concept in economics and finance, representing the equilibrium point where the demand for money equals the supply of money, resulting in a stable interest rate. This equilibrium is essential for ensuring efficient capital allocation, promoting economic stability, and guiding monetary policy decisions. In this post, we talk about the key concepts, determinants, and implications of money market equilibrium.

Table of Contents

ToggleWhat is Money Market Equilibrium | Different Definitions

While there isn’t a direct consensus among authors regarding the definition of money market equilibrium, different economists and scholars have provided varying perspectives on the concept. Here are a few interpretations from various authors:

-

Milton Friedman:

Milton Friedman, a prominent economist known for his work on monetary theory and the quantity theory of money, described money market equilibrium as the point where the demand for money equals the supply of money at a given interest rate. According to Friedman, changes in the money supply would adjust interest rates to bring the money market into equilibrium.

-

John Maynard Keynes:

Keynes, in his General Theory of Employment, Interest, and Money, viewed money market equilibrium as the condition where the liquidity preference, or the desire to hold money rather than other assets, matches the quantity of money supplied. Keynes emphasized the role of interest rates in balancing the demand for and supply of money, influencing investment and economic activity.

-

Paul Samuelson:

Paul Samuelson, a Nobel laureate in economics, provided a neoclassical perspective on money market equilibrium, emphasizing the interaction between the money supply, money demand, and interest rates. According to Samuelson, money market equilibrium occurs when the quantity of money demanded equals the quantity of money supplied, determining the equilibrium interest rate in the economy.

-

Irving Fisher:

Irving Fisher, an American economist known for his contributions to monetary economics, described money market equilibrium as the point where the nominal interest rate adjusts to equate the demand for money with the supply of money. Fisher’s theory of interest rates emphasized the role of inflation expectations and the real return on assets in determining money market equilibrium.

-

James Tobin:

James Tobin, another influential economist, introduced the concept of the liquidity preference framework, which considers the trade-off between holding money and holding other assets. Tobin’s model of money market equilibrium incorporates portfolio choice and asset allocation decisions, reflecting the preferences of investors and households for different forms of money and financial assets.

These various definitions and perspectives highlight the complexity of money market equilibrium and the diverse theoretical approaches used by economists to analyze it. While there may be differences in terminology and emphasis among authors, the underlying concept of money market equilibrium revolves around the balance between the demand for and supply of money at a stable interest rate, influencing economic activity, investment decisions, and monetary policy outcomes.

Key Concepts of Money Market Equilibrium

Let’s see the key concepts underlying money market equilibrium in detail:

-

Demand for Money:

The demand for money represents the desire of individuals, businesses, and financial institutions to hold liquid assets, such as cash and bank deposits, for various purposes. The demand for money is influenced by several factors:

Transactional Demand: Money is held to facilitate everyday transactions, such as buying goods and services. The level of economic activity and the frequency of transactions influence the transactional demand for money.

Precautionary Demand: Money is held as a precautionary measure to cover unforeseen expenses or emergencies. The precautionary demand for money depends on factors such as income stability, uncertainty, and risk aversion.

Speculative Demand: Money is held as a speculative asset, with individuals and businesses choosing to hold cash or liquid assets based on expectations about future interest rates, asset prices, and investment opportunities. Speculative demand for money is influenced by factors such as interest rate expectations, investment opportunities, and risk preferences.

-

Supply of Money:

The supply of money refers to the total amount of money available in the economy, which includes currency in circulation and bank deposits. The supply of money is influenced by several factors:

Monetary Policy: Central banks control the money supply through various monetary policy tools, such as open market operations, reserve requirements, and discount rate adjustments. Expansionary monetary policy measures increase the money supply, while contractionary measures reduce it.

Banking System Operations: Commercial banks create money through the process of credit creation when they extend loans to borrowers. Changes in lending practices, deposit levels, and reserve management influence the supply of money in the banking system.

Currency Issuance: The central bank is responsible for issuing currency, which contributes to the total supply of money in the economy. Currency issuance and circulation affect the availability of physical cash in the economy.

-

Interest Rates as the Price of Money:

Interest rates play a crucial role in money market equilibrium as they serve as the price of money, balancing the demand for and supply of funds. Key aspects of interest rates in the context of money market equilibrium include:

Equilibrium Interest Rate: The equilibrium interest rate is the prevailing rate at which the demand for money equals the supply of money, resulting in money market equilibrium. Changes in the equilibrium interest rate reflect adjustments in the money supply and demand to maintain balance in the money market.

Influence on Borrowing and Lending: Interest rates influence borrowing and lending decisions by determining the cost of borrowing for borrowers and the return on lending for lenders. Changes in interest rates affect investment decisions, consumption patterns, and overall economic activity.

Monetary Policy Transmission: Central banks use changes in interest rates as a monetary policy tool to influence economic activity and inflation. By adjusting interest rates, central banks can influence borrowing costs, investment incentives, and the overall level of demand in the economy.

Understanding these key concepts is essential for analyzing the dynamics of money market equilibrium, the interaction between the demand for and supply of money, and the role of interest rates in shaping economic outcomes. By balancing the demand for and supply of money at a stable interest rate, money market equilibrium contributes to efficient capital allocation, price stability, and overall economic stability.

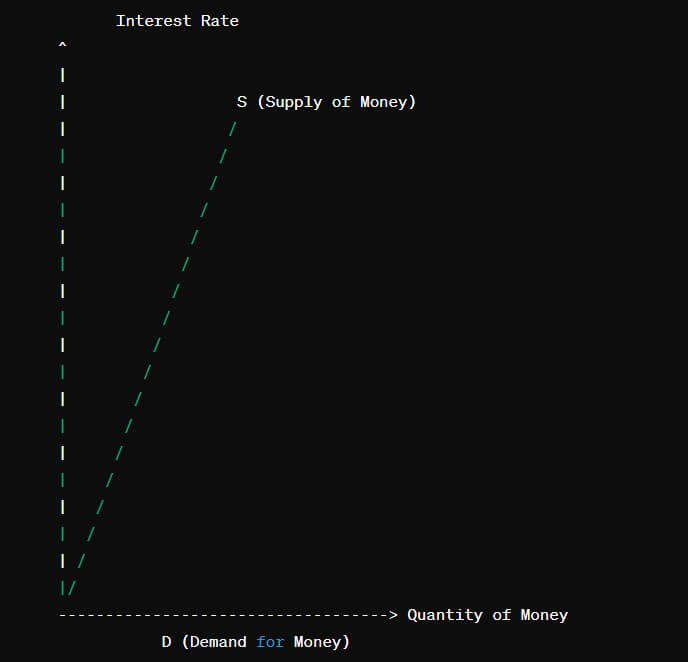

Money Market Equilibrium Graph

Money market equilibrium can be illustrated graphically using the supply and demand framework. In this graph, the vertical axis represents the interest rate (or nominal interest rate), while the horizontal axis represents the quantity of money.

-

Demand for Money Curve:

The demand for money curve slopes downwards from left to right, indicating an inverse relationship between the interest rate and the quantity of money demanded. At higher interest rates, individuals and businesses tend to hold less money for transactions and investment purposes, preferring to invest in interest-bearing assets. Conversely, at lower interest rates, the opportunity cost of holding money decreases, leading to an increase in the quantity of money demanded.

-

Supply of Money Curve:

The supply of money curve is typically represented as a vertical line, indicating that it is determined by monetary policy actions rather than by changes in the interest rate. The supply of money curve represents the fixed quantity of money supplied by the central bank through its monetary policy operations, such as open market operations, reserve requirements, and discount rate adjustments.

-

Equilibrium Point:

The equilibrium point in the money market is where the demand for money curve intersects with the supply of money curve. At this point, the quantity of money demanded by households and businesses equals the quantity of money supplied by the central bank. The equilibrium interest rate corresponding to this point is the prevailing interest rate in the economy that balances the supply of and demand for money.

-

Impact of Shifts:

Changes in the determinants of money demand or money supply can lead to shifts in the respective curves. For example, an increase in income levels or economic activity may lead to an outward shift in the demand for money curve, increasing the equilibrium interest rate. Conversely, expansionary monetary policy measures that increase the money supply would shift the supply of money curve to the right, lowering the equilibrium interest rate.

In the above graph:

- The equilibrium point where the supply and demand curves intersect represents the money market equilibrium.

- Changes in the determinants of money demand or money supply would lead to shifts in the respective curves, resulting in a new equilibrium interest rate and quantity of money.

This graphical representation helps visualize how changes in the supply of and demand for money impact the equilibrium interest rate in the money market, highlighting the role of monetary policy and economic factors in determining money market equilibrium.

Determinants of Money Market Equilibrium

The determination of money market equilibrium involves the interaction of various factors that influence both the demand for and supply of money. Understanding these determinants is crucial for analyzing the dynamics of the money market and how changes in economic conditions and policy actions affect interest rates and the allocation of funds. Let’s explore the determinants of money market equilibrium in detail:

-

Monetary Policy Actions:

Central banks play a central role in influencing money market equilibrium through their monetary policy decisions. The following tools are used by central banks to affect the money supply and, consequently, interest rates:

Open Market Operations (OMO): Central banks conduct open market operations by buying or selling government securities in the open market. When the central bank purchases securities, it injects liquidity into the financial system, increasing the money supply and lowering interest rates. Conversely, when the central bank sells securities, it withdraws liquidity from the system, reducing the money supply and raising interest rates.

Reserve Requirements: Central banks set reserve requirements, which mandate the percentage of deposits that banks must hold in reserve. By adjusting reserve requirements, central banks can influence the amount of money banks can lend out, thereby affecting the money supply and interest rates. Lowering reserve requirements increases the amount of funds available for lending, while raising reserve requirements has the opposite effect.

Discount Rate: The discount rate is the interest rate at which commercial banks can borrow funds from the central bank. Changes in the discount rate influence the cost of borrowing for banks, which, in turn, affects their lending behavior and the overall money supply. Lowering the discount rate encourages banks to borrow more, increasing the money supply and lowering interest rates, while raising the discount rate has the opposite effect.

-

Economic Conditions:

Various macroeconomic factors affect the demand for and supply of money, thereby influencing money market equilibrium:

GDP Growth: Economic growth impacts the demand for money as businesses and consumers require funds for investment and spending. Strong economic growth may lead to higher demand for money, increasing interest rates, while weak growth may result in lower demand and lower interest rates.

Inflation Expectations: Expectations about future inflation affect the demand for money and interest rates. Higher inflation expectations may lead to higher demand for money as individuals seek to hold more liquid assets to protect against purchasing power erosion. This increased demand for money may lead to higher interest rates to equate supply and demand.

Unemployment: The level of unemployment influences the demand for money as employed individuals have a greater need for transactional and precautionary cash holdings. Changes in unemployment rates can affect consumer spending patterns and investment decisions, impacting the demand for money and interest rates.

-

Financial Market Dynamics:

Financial market conditions and investor sentiment also play a role in shaping money market equilibrium:

Risk Appetite: Investor risk appetite influences the demand for various financial assets, including money. In times of heightened risk aversion, investors may prefer holding liquid assets such as cash, leading to increased demand for money and higher interest rates.

Market Liquidity: Liquidity conditions in financial markets affect the ease with which assets can be bought or sold. Tighter liquidity may lead to higher demand for money as investors seek to hold more liquid assets, potentially driving up interest rates.

Expectations and Sentiment: Investor expectations about future economic conditions, policy actions, and market developments influence their demand for money and willingness to lend. Positive sentiment may lead to higher demand for riskier assets, while negative sentiment may increase demand for safe-haven assets like cash, impacting money market equilibrium.

By considering these determinants, policymakers, investors, and market participants can gain insights into the factors driving money market equilibrium and anticipate how changes in economic conditions and policy actions may impact interest rates and financial markets. A thorough understanding of these determinants is essential for effective monetary policy formulation, risk management, and investment decision-making.

Monetary Policy and Money Market Equilibrium

Monetary policy plays a pivotal role in shaping money market equilibrium by influencing the supply of and demand for money, ultimately determining the equilibrium interest rate in the economy. Understanding the relationship between monetary policy and money market equilibrium is essential for analyzing how central bank actions affect interest rates, economic activity, and inflation dynamics. Let’s explore this relationship in detail:

-

Tools of Monetary Policy:

Central banks utilize a range of tools to implement monetary policy and influence money market equilibrium:

Open Market Operations (OMO): Central banks conduct open market operations by buying or selling government securities in the open market. When the central bank purchases securities, it injects liquidity into the financial system, increasing the money supply and lowering short-term interest rates. Conversely, when the central bank sells securities, it withdraws liquidity from the system, reducing the money supply and raising short-term interest rates.

Reserve Requirements: Central banks set reserve requirements, which mandate the percentage of deposits that banks must hold in reserve. By adjusting reserve requirements, central banks can influence the amount of funds banks can lend out, thereby affecting the money supply and interest rates. Lowering reserve requirements increases the amount of funds available for lending, while raising reserve requirements has the opposite effect.

Discount Rate: The discount rate is the interest rate at which commercial banks can borrow funds from the central bank. Changes in the discount rate influence the cost of borrowing for banks, which, in turn, affects their lending behavior and the overall money supply. Lowering the discount rate encourages banks to borrow more, increasing the money supply and lowering short-term interest rates, while raising the discount rate has the opposite effect.

Interest on Reserves (IOR): Central banks may pay interest on reserves held by commercial banks, providing an additional tool to influence the money supply and interest rates. By adjusting the interest rate paid on reserves, central banks can influence banks’ incentive to hold excess reserves rather than lending them out. Lowering the interest rate on reserves may encourage banks to lend more, increasing the money supply and lowering interest rates, while raising the interest rate on reserves may have the opposite effect.

-

Transmission Mechanism:

Monetary policy actions impact money market equilibrium through various channels:

Interest Rate Channel: Changes in the money supply and central bank interest rates directly affect short-term interest rates in the money market. Lowering interest rates stimulates borrowing and investment, leading to increased money demand and economic activity. Conversely, raising interest rates discourages borrowing and investment, reducing money demand and economic activity.

Asset Price Channel: Monetary policy actions can also influence asset prices, including stocks, bonds, and real estate. Changes in interest rates affect the discounting of future cash flows, impacting asset valuations. Rising asset prices may lead to wealth effects, boosting consumer spending and economic activity, while falling asset prices may have the opposite effect.

Exchange Rate Channel: Changes in interest rates resulting from monetary policy actions can impact exchange rates by affecting capital flows and investor expectations. Lowering interest rates may lead to capital outflows, depreciating the domestic currency and boosting exports. Conversely, raising interest rates may attract capital inflows, appreciating the domestic currency and dampening exports.

-

Objectives and Challenges:

Central banks formulate monetary policy with the primary objectives of price stability, full employment, and economic growth. However, achieving these objectives while maintaining financial stability can pose challenges:

Inflation Targeting: Many central banks adopt inflation targeting frameworks, aiming to achieve a specific inflation target over the medium term. Monetary policy actions are geared towards anchoring inflation expectations and ensuring price stability while avoiding excessive inflation or deflation.

Output and Employment Goals: Central banks also consider output and employment goals when formulating monetary policy. By influencing interest rates and economic activity, monetary policy can impact employment levels and output growth, although the trade-offs between inflation and unemployment, known as the Phillips curve, may influence policy decisions.

Financial Stability Concerns: While monetary policy is primarily focused on macroeconomic objectives, central banks also monitor financial stability risks, including asset bubbles, excessive leverage, and systemic risks. Accommodative monetary policy may lead to financial imbalances and speculative behavior, necessitating macroprudential measures to address potential risks to financial stability.

The relationship between monetary policy and money market equilibrium is complex and multifaceted. Central banks utilize various policy tools to influence the money supply, interest rates, and economic activity, with the ultimate goal of achieving macroeconomic stability and promoting sustainable growth. By understanding the transmission mechanisms and objectives of monetary policy, policymakers, investors, and market participants can better anticipate the impact of central bank actions on money market equilibrium and financial markets.

Financial Market Dynamics and Money Market Equilibrium

Financial market dynamics play a significant role in shaping money market equilibrium, influencing the supply of and demand for money and ultimately determining the equilibrium interest rate in the economy. Understanding these dynamics is essential for analyzing how changes in investor sentiment, risk appetite, and liquidity preferences impact money market equilibrium and interest rate levels. Let’s delve into the relationship between financial market dynamics and money market equilibrium in detail:

-

Risk Appetite and Investor Sentiment:

Investor sentiment and risk appetite affect financial market dynamics and money market equilibrium in several ways:

Risk-On vs. Risk-Off Sentiment: Changes in investor sentiment can lead to shifts between risk-on and risk-off market environments. During periods of risk aversion, investors seek safe-haven assets such as cash and government securities, increasing the demand for money and driving down interest rates. Conversely, during risk-on periods, investors may be more willing to take on riskier assets, reducing the demand for money and potentially raising interest rates.

Flight to Quality: Heightened uncertainty or financial market volatility may trigger a flight to quality, with investors seeking refuge in low-risk assets. This flight to quality increases the demand for safe-haven assets, including cash and short-term government securities, leading to lower interest rates and higher demand for money.

Investor Confidence: Investor confidence plays a crucial role in shaping financial market dynamics. Positive sentiment may lead to increased risk-taking behavior and investment activity, stimulating economic growth and reducing the demand for money. Conversely, negative sentiment may dampen investment and consumption, increasing the demand for money and lowering interest rates.

-

Liquidity Preferences:

Liquidity preferences refer to investors’ preferences for holding liquid assets that can be easily bought or sold without significant price impact. Changes in liquidity preferences affect money market equilibrium in the following ways:

Flight to Liquidity: During periods of heightened uncertainty or market stress, investors may prioritize liquidity over returns, increasing demand for highly liquid assets such as cash and short-term government securities. This flight to liquidity drives down interest rates and increases the demand for money.

Market Liquidity Conditions: Tightening liquidity conditions in financial markets can lead to increased demand for money as investors seek to hold more liquid assets. Reduced market liquidity may result in higher transaction costs and wider bid-ask spreads, prompting investors to hold more cash and lowering interest rates.

Credit Market Conditions: Changes in credit market conditions, including credit availability, credit spreads, and risk premiums, influence investor liquidity preferences and demand for money. Tighter credit conditions may lead to increased demand for cash as investors deleverage or reduce exposure to riskier assets, lowering interest rates and increasing the demand for money.

-

Impact on Money Market Equilibrium:

Financial market dynamics directly impact money market equilibrium by influencing the supply of and demand for money and interest rate levels:

Demand for Money: Changes in investor sentiment, risk appetite, and liquidity preferences affect the demand for money. Increased demand for cash and liquid assets drives down interest rates, while decreased demand leads to higher interest rates.

Supply of Money: Financial market conditions also impact the supply of money through changes in bank lending behavior, credit conditions, and central bank policy actions. Expansionary monetary policy measures, such as quantitative easing, increase the money supply and lower interest rates, while contractionary measures have the opposite effect.

Equilibrium Interest Rates: The interaction of supply and demand for money determines the equilibrium interest rate in the money market. Financial market dynamics influence interest rate levels, with changes in investor sentiment, liquidity preferences, and credit market conditions affecting the balance between supply and demand for money.

Financial market dynamics play a crucial role in shaping money market equilibrium by influencing investor sentiment, risk appetite, and liquidity preferences. Changes in financial market conditions impact the demand for and supply of money, ultimately determining interest rate levels and the allocation of funds in the economy. By understanding these dynamics, policymakers, investors, and market participants can better anticipate changes in money market equilibrium and adjust their strategies accordingly.

Importance of Money Market Equilibrium

Money market equilibrium holds significant importance in the functioning of the financial system and the broader economy. It serves as a critical mechanism for balancing the supply of and demand for funds, determining interest rates, and facilitating efficient capital allocation. Let’s explore the importance of money market equilibrium in detail:

-

Efficient Capital Allocation:

Money market equilibrium ensures the efficient allocation of funds by balancing the supply of and demand for money at a stable interest rate. When the demand for money equals the supply, interest rates adjust to reflect the true cost of borrowing and the opportunity cost of holding cash. This equilibrium interest rate signals to borrowers and lenders where capital is most needed and where it can be deployed most productively. Efficient capital allocation fosters investment in productive projects, supports economic growth, and enhances overall welfare.

-

Price Stability:

Money market equilibrium contributes to price stability by anchoring inflation expectations and minimizing the risk of excessive credit expansion or contraction. When supply and demand for money are in balance, interest rates reflect underlying economic conditions and inflation expectations. Stable interest rates help to anchor inflation expectations, preventing inflationary pressures from spiraling out of control. Price stability is essential for maintaining the purchasing power of money, promoting confidence in the economy, and fostering long-term sustainable growth.

-

Financial Stability:

Well-functioning money market equilibrium promotes financial stability by reducing the likelihood of liquidity crises, bank failures, and systemic risks. Stable interest rates and efficient capital allocation mitigate the buildup of financial imbalances and speculative bubbles. By aligning the supply of and demand for money, money market equilibrium helps to prevent excessive risk-taking behavior and promotes prudent financial practices. Financial stability is crucial for maintaining the resilience of the financial system and safeguarding against systemic shocks.

-

Monetary Policy Effectiveness:

Money market equilibrium is essential for the effective implementation of monetary policy by central banks. Central banks use changes in interest rates to influence economic activity, inflation, and employment. When money market equilibrium is disrupted, it can impair the transmission mechanism of monetary policy, making it more challenging for central banks to achieve their policy objectives. By closely monitoring money market conditions and ensuring equilibrium is maintained, central banks can enhance the effectiveness of their monetary policy actions.

-

Economic Growth and Development:

Maintaining money market equilibrium is conducive to fostering economic growth and development. Stable interest rates encourage investment, entrepreneurship, and innovation, driving productivity gains and raising living standards. Efficient capital allocation channels savings into productive investments, supporting the expansion of businesses, job creation, and income growth. By providing a conducive environment for financial intermediation and investment, money market equilibrium contributes to sustainable economic development.

Money market equilibrium plays a pivotal role in the functioning of the financial system and the broader economy. It ensures efficient capital allocation, promotes price stability, fosters financial stability, enhances monetary policy effectiveness, and supports economic growth and development. Policymakers, regulators, and market participants recognize the importance of maintaining money market equilibrium to promote stability, resilience, and prosperity in the economy.

Money Market Equilibrium Definition | Key Concepts | Graph | Determinants | Importance | PDF Free Download |

Conclusion

Money market equilibrium represents the equilibrium point where the demand for money equals the supply of money, resulting in a stable interest rate. Understanding the determinants and implications of money market equilibrium is essential for policymakers, investors, and market participants in navigating financial markets, promoting economic stability, and fostering sustainable growth.

By analyzing the interplay of monetary policy actions, macroeconomic conditions, and financial market dynamics, stakeholders can better anticipate changes in money market equilibrium and formulate effective strategies to achieve their economic objectives.

See Also: What is Money Supply | Definition | Types | Components | Factors | Criticism