In the realm of macroeconomics, the Investment Demand Curve plays a pivotal role in understanding the dynamics of economic activity. It represents the relationship between the level of investment in an economy and various factors that influence investment decisions.

Table of Contents

ToggleWhat is Investment Demand Curve | Different Definitions

The Investment Demand Curve is a fundamental concept in macroeconomics that illustrates the relationship between the level of investment in an economy and the factors influencing investment decisions. Various economists have provided definitions to capture the essence of the Investment Demand Curve:

- John Maynard Keynes defined the Investment Demand Curve as the schedule that shows the amounts of investment that business owners are willing to undertake at different possible rates of interest. According to Keynesian theory, there is an inverse relationship between the interest rate and the level of investment.

- Irving Fisher: Fisher viewed the Investment Demand Curve as a representation of the trade-off between the present and the future, where the interest rate plays a crucial role in shaping investment choices.

- Paul Samuelson: Samuelson explained the Investment Demand Curve as a graphical representation reflecting the sensitivity of investment spending to changes in interest rates. In his work, he highlighted the role of expectations, economic conditions, and interest rate dynamics in determining the level of investment.

- Milton Friedman: His definition of the Investment Demand Curve focused on the impact of changes in the money supply and the stability of the financial system.

These definitions collectively highlight the significance of interest rates, expectations, and economic conditions in shaping the Investment Demand Curve. While there may be variations in emphasis and approach among different economists, the core idea remains rooted in the relationship between investment and key influencing factors.

Factors Influencing Investment Demand

Investment demand, a critical component of economic activity, is influenced by a multitude of factors that shape the decisions of businesses and investors. Understanding these factors is crucial for comprehending the dynamics of the Investment Demand Curve. Here is a detailed exploration of the key elements that influence investment demand:

-

Interest Rates:

Inverse Relationship: One of the primary determinants is the prevailing interest rate. As interest rates rise, the cost of financing investments increases, leading to a decrease in investment demand. Conversely, lower interest rates tend to stimulate investment.

-

Expected Rate of Return:

Profitability Considerations: Businesses assess the expected returns on their investments. If the anticipated rate of return is high, investment demand is likely to increase. Factors influencing this expectation include market conditions, technological advancements, and business strategies.

-

Business Confidence:

Optimism vs. Pessimism: The confidence level of businesses plays a crucial role. Optimistic outlooks regarding future economic conditions, consumer demand, and regulatory stability tend to boost investment. Conversely, uncertainty or pessimism can lead to a decline in investment.

-

Economic Conditions:

Growth and Stability: The overall economic environment, including GDP growth, inflation, and unemployment rates, significantly affects investment decisions. During periods of economic expansion and stability, businesses are more inclined to invest.

-

Government Policies:

Fiscal and Monetary Measures: Government policies, such as tax incentives, subsidies, and interest rate adjustments by central banks, can impact investment demand. Favorable policies often encourage businesses to undertake more investment projects.

-

Technological Advances:

Innovation and Efficiency: The pace of technological advancements influences investment decisions. Industries that embrace innovation and technological upgrades often experience increased investment as businesses seek to enhance efficiency and competitiveness.

-

Credit Availability:

Access to Financing: The availability of credit and financing options is vital for investment. Businesses rely on loans and capital markets to fund projects. Tight credit conditions can restrict investment, while easy access can spur economic expansion.

-

Global Economic Conditions:

Trade and External Factors: The interconnectedness of the global economy means that international conditions, including trade agreements, geopolitical stability, and exchange rates, can impact investment decisions.

-

Consumer Demand:

Market Appetite: The level of consumer demand for goods and services influences investment, especially in industries directly tied to consumer spending. High demand prompts businesses to expand production capacities.

-

Regulatory Environment:

Stability and Predictability: A stable and predictable regulatory environment is crucial for investment planning. Uncertain or constantly changing regulations can deter businesses from making long-term investment commitments.

Understanding the intricate interplay of these factors provides insights into the complex nature of investment demand. Businesses and policymakers alike must navigate these influences to foster an environment conducive to sustained economic growth.

Understanding the Investment Demand Curve

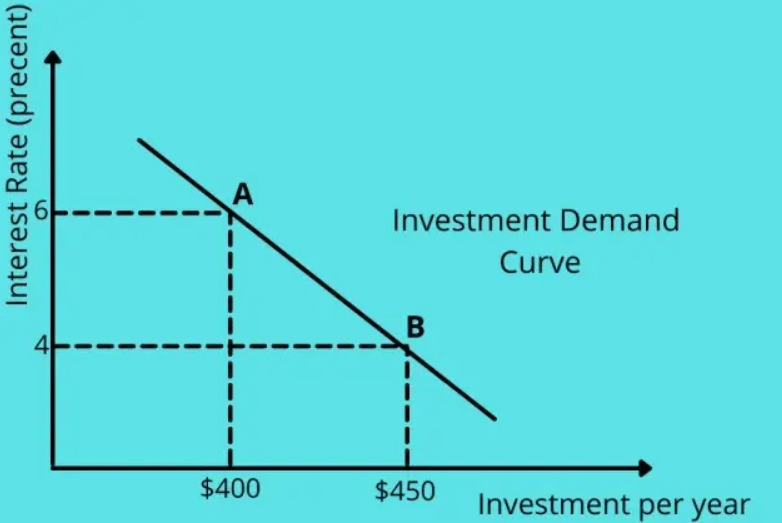

The Investment Demand Curve is a fundamental concept in economics that illustrates the relationship between the level of investment in an economy and the prevailing interest rates. Two key elements play a pivotal role in shaping this curve: the inverse relationship with interest rates and the impact of expectations on investment decisions.

Inverse Relationship with Interest Rates:

- Cost of Financing: The most crucial determinant of the Investment Demand Curve is the prevailing interest rate. Generally, there exists an inverse relationship between interest rates and investment. As interest rates rise, the cost of financing investments increases. Higher interest rates mean that businesses must pay more for borrowed capital, reducing the profitability of potential investments.

- Opportunity Cost: When interest rates are high, businesses may find alternative financial instruments, such as bonds or savings accounts, more attractive. The opportunity cost of investing in physical capital becomes higher, leading to a decrease in the quantity of investments demanded.

- Conversely, Lower Interest Rates: When interest rates are low, the cost of borrowing decreases. This makes investments more financially viable for businesses, leading to an increase in the quantity of investments demanded. Lower interest rates stimulate economic activity by encouraging businesses to undertake more investment projects.

Role of Expectations:

- Anticipated Returns: Expectations about future economic conditions, market trends, and potential returns on investment significantly influence the decisions of businesses. If businesses anticipate a favorable economic environment and higher expected returns on their investments, they are more likely to increase investment.

- Uncertainty and Pessimism: On the other hand, uncertainty, pessimism, or concerns about future economic conditions can lead to a decrease in investment. Businesses may delay or scale back investment projects when faced with unpredictability or a negative outlook.

- Effect on the Investment Demand Curve: Expectations essentially shift the entire Investment Demand Curve. Positive expectations shift the curve to the right, indicating an increase in investment demand at each interest rate level. Conversely, negative expectations shift the curve to the left, signaling a decrease in investment demand.

Understanding the interplay between interest rates and expectations provides valuable insights into the dynamics of the Investment Demand Curve. It highlights how changes in these factors can influence the level of investment in an economy, impacting overall economic activity and growth.

Policymakers and businesses closely monitor these dynamics to make informed decisions and conductive environment for sustained economic development.

Shifts in the Investment Demand Curve

The Investment Demand Curve, depicting the relationship between investment levels and interest rates, can experience shifts based on various factors beyond interest rates alone. Understanding these shifts is crucial for comprehending the nuanced dynamics of investment in an economy. Here are key factors influencing shifts in the Investment Demand Curve:

-

Expectations and Business Confidence:

Changes in business expectations can cause significant shifts in the curve. Optimistic expectations about future economic conditions, market trends, and potential profits can lead to an outward shift, indicating an increase in investment demand. Conversely, pessimism can shift the curve inward, signaling a decrease in investment demand.

-

Technological Advances and Innovation:

Technological advancements often require substantial investments in new equipment and processes. If there’s a wave of innovation that enhances the productivity of capital, businesses may be incentivized to invest more, resulting in a rightward shift of the curve.

-

Tax Policies and Incentives:

Changes in tax policies or the introduction of investment incentives by the government can influence investment decisions. Tax breaks or favorable investment conditions can lead to an increase in investment, shifting the curve to the right.

-

Availability of Credit and Financing:

Tightening or easing credit conditions affect the cost and availability of financing for businesses. If credit becomes more accessible or cheaper, it encourages higher levels of investment, causing the curve to shift outward.

-

Global Economic Conditions:

Economic conditions in the global market can impact investment demand. Favorable international economic trends may encourage businesses to expand their operations, leading to an outward shift. Adverse global conditions, on the other hand, can result in a leftward shift.

-

Political Stability and Regulatory Environment:

A stable political environment and favorable regulations can boost investor confidence. Increased confidence often translates into higher investment levels, causing a rightward shift in the curve.

-

Business Cycle Position:

The stage of the business cycle also plays a role. During an economic boom, businesses may be more inclined to invest, shifting the curve outward. Conversely, during a recession, businesses might cut back on investments, leading to an inward shift.

Understanding these factors provides a comprehensive view of the complexities that influence investment decisions. Shifts in the Investment Demand Curve reflect the dynamic nature of economic forces, and policymakers use this understanding to formulate strategies that promote a favorable investment climate for sustainable economic growth.

How to Determine Investment Demand Curve

The investment demand curve illustrates the relationship between the level of investment in an economy and the prevailing interest rates. Understanding and determining this curve is crucial for policymakers, economists, and businesses and here’s a step-by-step process to determine Investment Demand Curve.

-

Define Investment Demand:

Investment demand represents the total planned investment spending in an economy at different levels of real interest rates. It includes expenditures on capital goods, machinery, structures, and other long-term assets.

-

Understand the Inverse Relationship:

There is a generally inverse relationship between investment and interest rates. As interest rates rise, the cost of borrowing increases, making investment projects less attractive. Conversely, lower interest rates tend to stimulate investment.

-

Identify the Components:

Break down investment demand into its key components, including:

- Autonomous Investment: Independent of interest rates, representing investment that would occur even at a zero interest rate.

- Induced Investment: Dependent on interest rates, reflecting changes in investment as interest rates vary.

-

Consider Expectations:

Investment decisions are often influenced by expectations about future economic conditions. Positive expectations, such as anticipated economic growth, can increase investment demand even at higher interest rates.

- Factor in Risk and Uncertainty:

Assess the impact of risk and uncertainty on investment decisions. Economic stability and a favorable business environment can encourage higher investment levels.

-

Aggregate Planned Investment:

Sum the autonomous and induced investment components to derive the aggregate planned investment for each potential interest rate.

-

Plotting the Curve:

Plot the aggregate planned investment on the vertical axis and the real interest rates on the horizontal axis. The resulting curve represents the investment demand curve.

-

Shifts in the Curve:

Recognize that shifts in the investment demand curve can occur due to various factors:

- Changes in Business Confidence: Positive or negative shifts based on perceptions of economic conditions.

- Technological Advancements: Investments driven by innovations can shift the curve.

- Government Policies: Fiscal policies impacting investment incentives can lead to shifts.

-

Data Collection:

Utilize historical data and econometric methods to gather information on investment patterns, interest rates, and economic conditions. This empirical approach enhances the accuracy of the investment demand curve.

-

Econometric Modeling:

Employ econometric models to estimate the functional relationship between investment and interest rates. This involves statistical techniques to analyze historical data and predict future trends.

-

Policy Implications:

Evaluate the policy implications of the investment demand curve. Policymakers can use this information to formulate strategies for economic stabilization, fostering growth, and influencing interest rate policies.

Understanding and determining the investment demand curve are integral to making informed economic decisions. Policymakers, businesses, and analysts rely on this curve to anticipate investment behavior under different economic scenarios, contributing to effective economic management.

Limitations of the Investment Demand Curve

The investment demand curve, a crucial concept in macroeconomics, comes with its set of limitations that warrant careful consideration. Understanding these limitations is vital for policymakers, economists, and businesses when interpreting economic trends and making informed decisions. Let’s see the key limitations associated with the investment demand curve:

-

Simplified Assumptions:

The investment demand curve is often based on simplified assumptions about factors influencing investment, such as interest rates, expectations, and technological progress. In reality, these factors are interconnected and subject to constant change, making it challenging to capture their dynamics accurately.

-

Subjectivity in Expectations:

Expectations play a significant role in shaping investment decisions. However, expectations are subjective and can vary widely among investors. Predicting future economic conditions and investment opportunities with precision is inherently uncertain, introducing an element of unpredictability into the investment demand curve.

-

Dynamic Economic Conditions:

Economic conditions are dynamic and influenced by various external factors, including geopolitical events, technological advancements, and global economic trends. The investment demand curve assumes a stable economic environment, but in reality, the economy is subject to fluctuations and unexpected shocks that can significantly impact investment behavior.

-

Incomplete Consideration of Non-Interest Factors:

While interest rates are a primary determinant, the investment demand curve often focuses predominantly on this factor. Other non-interest factors, such as government policies, business regulations, and market sentiments, also play crucial roles in influencing investment decisions. Neglecting these factors can limit the curve’s accuracy in reflecting real-world scenarios.

-

Behavioral Factors:

Human behavior and psychological aspects contribute to investment decisions. Fear, optimism, and risk aversion are integral to investor psychology. These behavioral factors are challenging to quantify and incorporate into a standardized investment demand curve, potentially leading to oversimplified predictions.

-

Heterogeneity among Investors:

Investors vary in their risk preferences, time horizons, and financial goals. The investment demand curve often assumes a homogenous investor behavior, neglecting the diverse strategies and motivations that different investors bring to the market. This oversimplification can compromise the curve’s applicability in heterogeneous economic environments.

-

Unforeseen Externalities:

The investment demand curve may not adequately account for unforeseen externalities and black swan events that can disrupt economic stability. Events like natural disasters, financial crises, or global pandemics can have profound effects on investment patterns, challenging the predictive power of the curve.

-

Global Interconnectedness:

In an era of global interconnectedness, domestic investment decisions are increasingly influenced by international factors. Trade relationships, exchange rates, and global economic trends have repercussions on local investment dynamics, posing a challenge to the isolationist assumptions sometimes embedded in the investment demand curve.

Investment demand curve offers valuable insights into the relationship between interest rates and investment, its limitations highlight the need for a nuanced and context-specific understanding of economic behavior. Acknowledging these limitations fosters a more realistic interpretation of investment dynamics and encourages the integration of diverse factors into economic analyses.

Importance of Investment Demand in Macroeconomics

Investment demand plays a pivotal role in shaping the trajectory of an economy, influencing its growth, stability, and overall health. Here’s an in-depth exploration of the significance of investment demand in macroeconomics:

-

Economic Growth Engine:

Investment is a key driver of capital formation, contributing to the creation and expansion of physical and human capital. This, in turn, enhances productivity, efficiency, and the overall capacity of an economy to produce goods and services.

-

Job Creation and Employment:

Investment has a substantial multiplier effect on job creation. As businesses invest in new projects, expand operations, or upgrade technology, the demand for labor increases. This, in turn, reduces unemployment and fosters income generation.

-

Technological Advancement:

Investment often fuels technological advancements and innovation. Businesses invest in research and development, leading to the adoption of new technologies. This enhances productivity, fosters competitiveness, and can result in economic growth surpassing traditional trajectories.

-

Stabilizing Factor:

Investment demand can act as a counter-cyclical force, helping stabilize the economy during downturns. Increased investment during economic contractions can mitigate the severity of recessions by boosting demand, income, and employment.

-

Improved Standard of Living:

Sustained investment contributes to improvements in the standard of living. It facilitates the production of a diverse range of goods and services, providing consumers with choices and enhancing overall well-being.

-

Global Competitiveness:

Nations that attract significant investment often develop robust infrastructure and foster innovation. This enhances their global competitiveness, attracting more investment and creating a cycle of positive economic development.

-

Income and Consumption:

Investment contributes to income generation and wealth creation. As individuals and businesses earn more from productive investments, it translates into higher levels of consumption, further stimulating economic activity.

-

Long-Term Economic Sustainability:

Sustainable investments in areas such as renewable energy, education, and healthcare contribute to long-term economic sustainability. They address environmental concerns, enhance human capital, and create a foundation for enduring economic growth.

-

Government Revenue:

Investment activities generate tax revenues for the government. As businesses prosper, their taxable income increases, providing governments with funds to finance public services, infrastructure projects, and social programs.

Investment demand acts as the lifeblood of macroeconomics, fostering growth, stability, and prosperity. Its multifaceted impact on job creation, technological progress, and overall economic well-being underscores its critical role in shaping the trajectory of nations. Policymakers often focus on creating an environment conducive to robust investment to ensure sustained economic vitality.

Examples of Investment Demand Curve

The investment demand curve serves as a fundamental tool in macroeconomics, helping economists and policymakers understand the relationship between investment levels and interest rates. By examining the examples of investment demand curve, we can gain insights into how the investment demand curve operates in various economic scenarios:

-

Interest Rate Decline Stimulating Investment:

An illustrative example involves a scenario where central banks implement monetary policies to lower interest rates. As interest rates decrease, the cost of borrowing for businesses diminishes. This prompts firms to increase their investment in capital projects, such as expanding production facilities or adopting new technologies. The resulting upward shift in investment reflects a classic response captured by the investment demand curve.

-

Global Economic Uncertainty Leading to Reduced Investment:

During periods of global economic uncertainty, businesses may become more risk-averse. The uncertainty can lead to a decrease in investment levels, even if interest rates are relatively low. The investment demand curve, in this case, demonstrates how factors beyond interest rates, such as geopolitical tensions or trade disputes, can influence investment decisions and cause a leftward shift in the curve.

-

Technological Advancements Driving Investment:

Consider a situation where breakthrough technological advancements occur, offering businesses the opportunity to enhance productivity. This positive outlook can boost investor confidence and increase investment, showcasing a scenario where favorable expectations contribute to an upward movement along the investment demand curve.

-

Government Stimulus Encouraging Investment:

In response to an economic downturn, governments may implement fiscal policies, such as tax incentives or infrastructure spending, to stimulate investment. This deliberate effort to encourage businesses to invest is reflected in the investment demand curve, showcasing the impact of policy interventions on shaping investment behavior.

-

Consumer Preferences Shifting Investment:

Changes in consumer preferences can significantly influence investment decisions. For instance, if there is a noticeable shift toward environmentally sustainable products, businesses may redirect their investments to align with this trend. The investment demand curve captures how shifts in consumer preferences can lead to changes in the composition of investments across industries.

-

Credit Market Tightening Constraining Investment:

Periods of credit market tightening, where lending becomes more stringent, can hinder businesses’ ability to borrow for investment purposes. This constraint is reflected in a scenario where, despite favorable interest rates, investment remains subdued due to limited access to credit. The investment demand curve highlights the impact of credit market conditions on investment dynamics.

-

Economic Recession Depressing Investment:

During an economic recession, businesses may scale back investment plans due to reduced consumer demand and financial uncertainty. The resulting decline in investment corresponds to a downward movement along the investment demand curve, underscoring how broader economic conditions can influence investment decisions.

These examples demonstrate the versatility of the investment demand curve in explaining the intricate relationship between interest rates and investment behavior. By considering a range of economic factors and scenarios, we can appreciate the dynamic nature of investment decisions and the valuable insights offered by the investment demand curve in understanding these dynamics.

Investment Demand Curve | Definition | Factors | Determination | Limitations | Examples | PDF Free Download |

Conclusion

In conclusion, the Investment Demand Curve is a powerful tool for economists and policymakers, offering insights into the intricate relationship between investment and various influencing factors.

Its graphical and mathematical representations provide a framework for understanding economic dynamics. While acknowledging its limitations, the Investment Demand Curve remains a cornerstone in macroeconomic analysis, guiding strategies for fostering economic growth and stability.