Macroeconomic equilibrium is the bedrock of economic stability, representing the delicate balance between the total demand for goods and services and the total quantity supplied.

In this time period, economy seeks harmony, striving for a state where aggregate demand aligns seamlessly with aggregate supply. This equilibrium serves as a compass for policymakers and economists, guiding their decisions to foster sustainable growth and prevent economic turmoil.

The concept of macroeconomic equilibrium encapsulates the essence of a well-functioning economy. It goes beyond mere balance. It signifies a state where the aspirations of consumers, the ambitions of businesses, and the interventions of policymakers converge to create an environment conducive to prosperity.

Table of Contents

ToggleWhat is Macroeconomic Equilibrium | Different Definitions

Macroeconomic equilibrium refers to the state in an economy where the total quantity of goods and services demanded equals the total quantity supplied, resulting in overall stability. Various economists have offered definitions and perspectives on macroeconomic equilibrium, emphasizing its significance in understanding the health and functioning of an economy. Here are different definitions by notable authors:

- John Maynard Keynes viewed macroeconomic equilibrium as a state where aggregate demand (total spending in the economy) matches aggregate supply (total production). He emphasized the role of government intervention to address imbalances and stabilize the economy, particularly during times of recession.

- Milton Friedman saw equilibrium as a condition where the money supply grows at a steady rate, promoting price stability. He stressed the importance of monetary policy in maintaining a consistent and predictable environment for economic agents.

- Paul Samuelson defined macroeconomic equilibrium as a situation where planned savings equal planned investments. His contributions to the Keynesian synthesis highlighted the interplay between saving, investment, and overall economic equilibrium.

- Irving Fisher considered equilibrium as a state where these elements harmonize, influencing overall economic stability.

- According to Jean-Baptiste Say macroeconomic equilibrium is achieved through the smooth functioning of markets, where the production of goods ensures that sufficient income is generated to purchase those goods.

- Friedrich Hayek approached macroeconomic equilibrium from a perspective of market coordination. He argued that a decentralized market process, driven by individual actors responding to price signals, could lead to a spontaneous order and overall economic balance.

- John Hicks defined macroeconomic equilibrium as the point where planned investment equals planned savings, a concept aligned with Keynesian principles.

These varied perspectives highlight the multifaceted nature of macroeconomic equilibrium, incorporating elements of demand, supply, monetary dynamics, and market processes. The definitions by these influential economists underscore the ongoing discourse and evolution of economic thought regarding the attainment and maintenance of equilibrium in the broader economy.

Components of Macroeconomic Equilibrium

Macroeconomic equilibrium is a state where the overall economy is balanced, with the total quantity of goods and services demanded equaling the total quantity supplied. This equilibrium is influenced by various components that interact to determine the overall stability of the economy. Here are the key components of macroeconomic equilibrium explained in detail:

Aggregate Demand (AD):

Aggregate demand represents the total quantity of goods and services that consumers, businesses, government, and foreign buyers are willing to purchase at different price levels. It is a critical component as it reflects the spending patterns within the economy. Changes in factors like consumer confidence, interest rates, and government policies can impact aggregate demand and thus influence macroeconomic equilibrium.

Aggregate Supply (AS):

Aggregate supply represents the total quantity of goods and services that producers in an economy are willing to supply at different price levels. It is determined by factors such as technology, input costs, and the overall efficiency of production. Changes in these factors can lead to shifts in aggregate supply, affecting the equilibrium.

Price Level:

The overall price level in the economy plays a crucial role in determining equilibrium. Changes in the price level affect both aggregate demand and aggregate supply. In a state of equilibrium, the price level is such that the quantity of goods and services demanded equals the quantity supplied.

Output and Income:

Macroeconomic equilibrium ensures that the total output of goods and services (real GDP) matches the total income generated in the economy. This alignment is crucial for stability, as it reflects a situation where production meets income levels, contributing to overall economic well-being.

Interest Rates:

Interest rates influence the spending and investment behavior of economic agents. Central banks often use interest rates as a tool to manage inflation and economic activity. In a state of equilibrium, interest rates are consistent with the overall economic conditions, ensuring a balance between savings and investment.

Employment and Unemployment:

The level of employment and unemployment is a key component of macroeconomic equilibrium. Full employment is often considered a desirable state, where all available resources, including labor, are efficiently utilized. Equilibrium seeks to minimize cyclical unemployment and maintain a stable employment environment.

Government Policies:

Fiscal and monetary policies implemented by the government and central bank, respectively, impact macroeconomic equilibrium. Government spending, taxation, and monetary interventions can influence aggregate demand and supply, aiming to achieve stability and address economic challenges.

International Trade:

Global economic factors, such as exchange rates and trade balances, can affect macroeconomic equilibrium. Changes in international trade conditions, tariffs, and currency values impact the overall economic balance by influencing exports and imports.

Expectations:

Individual and institutional expectations about future economic conditions play a significant role in macroeconomic equilibrium. Rational expectations, where economic agents form predictions based on all available information, contribute to the overall stability of the economy.

Technological Changes:

Advances in technology can impact macroeconomic equilibrium by influencing productivity and production possibilities. Innovations can lead to shifts in aggregate supply, affecting the overall balance in the economy.

Understanding and managing these components are essential for policymakers, economists, and businesses to promote macroeconomic stability. The goal is to achieve a harmonious balance where the economy operates efficiently, providing optimal levels of output, employment, and overall well-being for its participants.

Macroeconomic Equilibrium Graph and Table

Macroeconomic equilibrium is a fundamental concept in economics, representing a state where aggregate demand equals aggregate supply in an economy. Graphs and tables are powerful tools to illustrate and analyze this equilibrium. Let’s check the detail explanation with the help of visual representations:

Macroeconomic Equilibrium Graph

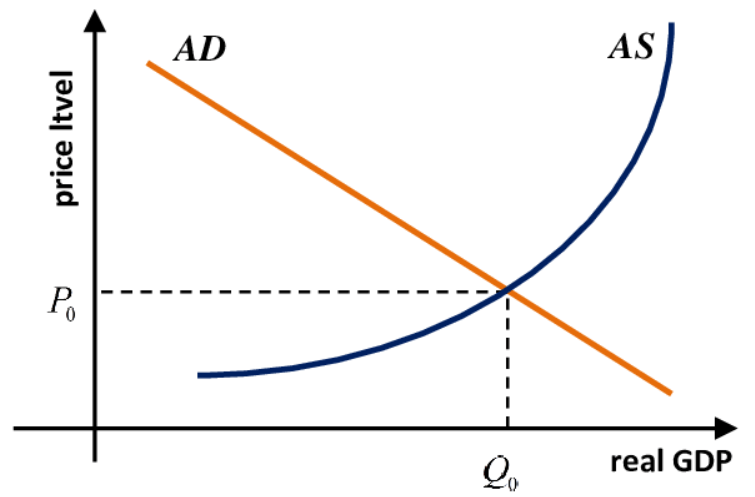

The Aggregate Demand and Aggregate Supply Model:

Aggregate Demand (AD) Curve:

- Represents the total quantity of goods and services demanded at different price levels

- Slopes downward, reflecting the inverse relationship between price levels and real output demanded

Short-Run Aggregate Supply (SRAS) Curve:

- Depicts the total quantity of goods and services that producers are willing to supply at different price levels

- Initially slopes upward due to sticky prices, indicating that higher prices lead to increased production

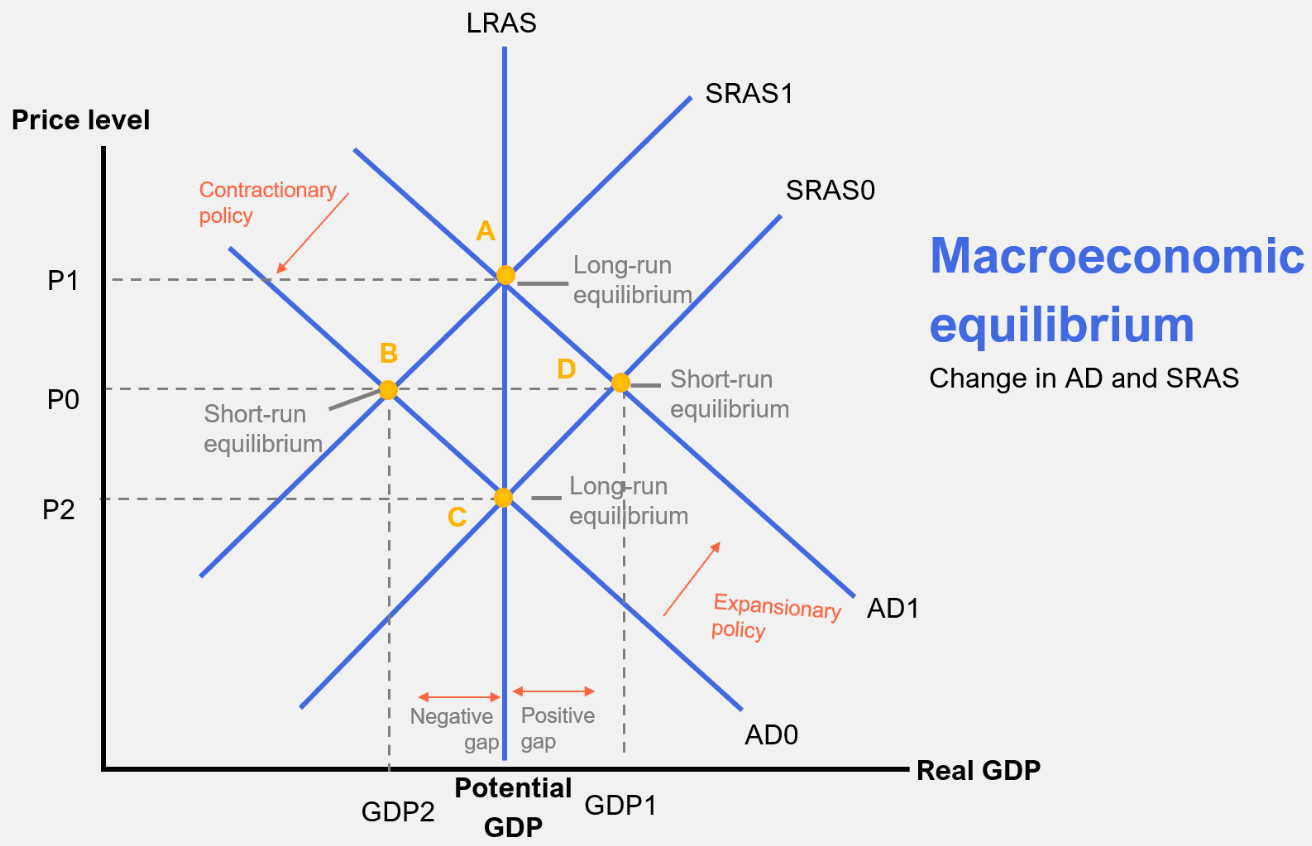

Long-Run Aggregate Supply (LRAS) Curve:

- Represents the economy’s potential output level in the long run

- Vertical at the full-employment level of output, indicating that prices do not affect the long-run output

Macroeconomic Equilibrium:

- Occurs where the AD curve intersects the SRAS curve

- Indicates the short-run equilibrium price level and real output

Shifts in Aggregate Demand and Supply:

Shifts in AD:

- Factors like changes in consumer confidence, government spending, or monetary policy can shift the AD curve.

- An increase in AD shifts the equilibrium to a higher price level and output, causing inflation.

Shifts in SRAS:

- Changes in production costs, technology, or labor markets can shift the SRAS curve.

- An increase in SRAS shifts the equilibrium to a higher output and lower price level.

Macroeconomic Equilibrium Table

| Price Level | Quantity Demanded (AD) | Quantity Supplied (SRAS) | Equilibrium Output |

|---|---|---|---|

| P1 | Q1 | Q2 | Qe |

| P2 | Q3 | Q4 | Qe |

| P3 | Q5 | Q6 | Qe |

- Price Level (P): Different levels of the price level.

- Quantity Demanded (AD): Corresponding quantity of goods and services demanded at each price level.

- Quantity Supplied (SRAS): Corresponding quantity of goods and services supplied at each price level.

- Equilibrium Output (Qe): The level of output where AD equals SRAS.

Graphs and tables are invaluable tools to visualize and analyze macroeconomic equilibrium. They illustrate how changes in aggregate demand, aggregate supply, and other factors impact the equilibrium price level and output in an economy. Understanding these graphical and tabular representations enhances our comprehension of the intricate dynamics within macroeconomics.

Factors Influencing Macroeconomic Equilibrium

Macroeconomic equilibrium is a state where the aggregate demand (AD) equals the aggregate supply (AS) in an economy. Achieving and maintaining this equilibrium is a dynamic process influenced by various factors that shape the overall economic landscape. Let’s explore the key factors that play a pivotal role in determining and influencing macroeconomic equilibrium.

Consumption Patterns:

The level of confidence among consumers significantly impacts their spending habits. High confidence may lead to increased consumption, contributing to equilibrium.

Also, changes in income levels directly affect consumer spending. Higher incomes generally lead to higher consumption, influencing the equilibrium position.

Investment Spending:

Similar to consumer confidence, the confidence of businesses in the economic environment influences their investment decisions. Positive sentiments may lead to increased investments, impacting equilibrium.

The cost of borrowing, determined by interest rates, affects investment spending. Lower interest rates often stimulate investments, contributing to equilibrium.

Government Policies:

Government decisions regarding taxation and spending can impact aggregate demand. Expansionary fiscal policies, such as tax cuts or increased public spending, can stimulate demand and move the economy toward equilibrium.

Central banks use monetary tools, like interest rates, to influence borrowing and spending. Adjustments in interest rates can impact consumption and investment, affecting equilibrium.

External Trade Conditions:

Changes in international trade conditions, such as exchange rates and global demand for exports, influence a country’s net exports. Shifts in net exports can impact the overall equilibrium position.

Technological Changes:

Advances in technology and increases in productivity can impact both aggregate demand and aggregate supply. Higher productivity may lead to increased output and consumption, affecting equilibrium.

Inflation Expectations:

If households and businesses expect future inflation, they may adjust their spending patterns. Anticipated inflation can impact the effectiveness of monetary policy and influence equilibrium.

Labor Market Conditions:

The level of unemployment in an economy is a key indicator of its health. High unemployment may indicate a lack of equilibrium, while low unemployment suggests optimal resource utilization.

Global Economic Conditions:

The overall health of the global economy can impact a country’s exports and imports, influencing its equilibrium position. Global economic downturns or upturns can have ripple effects.

Understanding these factors and their interplay is essential for policymakers, economists, and businesses seeking to anticipate and respond to changes in the macroeconomic equilibrium. Continuous monitoring and analysis of these variables contribute to informed decision-making and the overall stability of an economy.

Role of Prices and Wages in Macroeconomic Equilibrium

In the complex web of macroeconomic forces, prices and wages serve as crucial elements that influence the equilibrium of an economy. Understanding how these factors interact and adjust is vital for grasping the dynamics of macroeconomic equilibrium. Let’s see the intricacies of the role played by prices and wages in maintaining balance within the marketplace.

Price Levels and Inflation:

Demand-Pull Inflation: When aggregate demand outpaces aggregate supply, it exerts upward pressure on prices. This demand-pull inflation can disrupt equilibrium by eroding purchasing power and affecting consumer and business decisions.

Cost-Push Inflation: On the supply side, increases in production costs, such as rising wages or resource prices, can lead to cost-push inflation. This inflationary pressure influences pricing decisions and can disturb macroeconomic equilibrium.

Wage Determinants and Labor Market:

Labor Market Conditions: The level of employment and the bargaining power of labor influence wage rates. In an economy with high unemployment, wages may stagnate, impacting consumers’ purchasing ability and affecting aggregate demand.

Productivity and Wages: Increases in worker productivity are often linked to higher wages. Productivity gains can contribute to equilibrium by fostering economic growth and supporting higher living standards.

Price and Wage Stickiness:

Prices and wages may exhibit stickiness, meaning they don’t adjust immediately to changes in supply and demand. This stickiness can result from contracts, regulations, or psychological factors, impacting the speed at which equilibrium is restored.

Relative Price Changes:

Changes in relative prices, such as fluctuations in commodity prices or exchange rates, can affect the distribution of income and impact spending patterns. These shifts influence the equilibrium by altering the composition of aggregate demand.

Interest Rates and Capital Markets:

Central banks, through monetary policy, influence interest rates. Changes in interest rates can affect the cost of borrowing, impacting investment and consumption decisions and, consequently, macroeconomic equilibrium.

Price Expectations and Consumer Behavior:

Expectations about future prices can influence consumer behavior. If consumers anticipate rising prices, they may adjust their spending patterns. This psychological aspect can impact aggregate demand and disrupt equilibrium.

Wage-Price Spiral:

The wage-price spiral describes a situation where rising wages lead to higher production costs, resulting in businesses raising prices. This cycle can perpetuate inflationary pressures and disturb macroeconomic equilibrium.

Globalization and Trade:

Changes in global prices and trade conditions can influence domestic prices. Inflationary or deflationary pressures from global markets can impact the overall price level and, consequently, macroeconomic equilibrium.

Achieving and maintaining macroeconomic equilibrium requires a delicate balance between the forces of supply and demand, with prices and wages acting as critical adjustment mechanisms. Policymakers, businesses, and individuals closely monitor these factors to anticipate and respond to changes, contributing to the stability of the overall economic system.

Long-Run Macroeconomic Equilibrium

In the realm of macroeconomics, achieving equilibrium is not just a short-term goal; economists are equally concerned with establishing stability in the long run. The long-run macroeconomic equilibrium represents a state where various economic forces have settled into a balanced and sustainable configuration. Let’s see the detailed exploration of the factors and conditions that characterize long-run equilibrium.

Definition and Characteristics:

The long run extends beyond the immediate future, allowing for adjustments to fully unfold. It’s a period where all prices, including wages, have had the opportunity to adapt to changes in supply and demand.

Flexible Prices and Wages:

In the long run, prices and wages are assumed to be flexible and capable of adjusting to changes in market conditions. Unlike the short run, where stickiness may prevail, flexibility is a key feature in achieving long-run equilibrium.

Full Employment:

Long-run equilibrium implies the economy operates at its natural rate of unemployment, the level where all individuals who are willing and able to work at prevailing wage rates find employment.

Constant Output and Growth:

In long-run equilibrium, the economy reaches a steady state where the growth rate is constant. Output stabilizes at a level consistent with the economy’s productive capacity and technological advancements.

Neutrality of Money:

The long run assumes that money is neutral, meaning changes in the money supply do not affect real variables like output and employment. Monetary policy may impact nominal values, but it is considered neutral in influencing real economic activity in the long run.

Balanced Budgets:

Long-run equilibrium envisions fiscal policies that are sustainable over time. Governments aim for balanced budgets or budgets that contribute to stable debt-to-GDP ratios, ensuring fiscal responsibility and stability.

Technological Progress:

Long-run equilibrium incorporates the effects of technological progress. As innovations unfold, they contribute to increased productivity, influencing the economy’s capacity to produce goods and services.

External Stability:

In the long run, economies seek external stability, aiming for a sustainable trade balance. This involves considerations of exchange rates, competitiveness, and global economic conditions.

Environmental and Social Considerations:

Achieving long-run equilibrium involves accounting for environmental and social considerations. Sustainable economic practices and policies that promote well-being over the long term are integral to this equilibrium.

Policy Implications:

Policymakers must adopt measures that support long-run stability. These may include education and training programs, research and development initiatives, and policies that foster a conducive environment for innovation and entrepreneurship.

Long-run macroeconomic equilibrium is a dynamic concept that reflects the intricate interplay of economic, social, and environmental factors. While short-run fluctuations are inevitable, the pursuit of stability in the long run remains a central objective in macroeconomic policy and analysis.

Limitations of Macroeconomic Equilibrium

Macroeconomic equilibrium, while a fundamental concept in economic analysis, is not without its limitations. Understanding these limitations is crucial for policymakers, economists, and individuals navigating the complexities of the economy. Let’s see the key constraints associated with the concept of macroeconomic equilibrium:

Aggregated Analysis:

Macroeconomic equilibrium involves aggregating various economic variables, masking the diversity of individual behaviors and preferences. This oversimplification can lead to a loss of nuance and may not capture the intricacies of diverse economic agents.

Assumption of Homogeneity:

The concept assumes a degree of homogeneity among economic agents. In reality, individuals and businesses exhibit diverse behaviors, making it challenging to accurately predict reactions to policy changes or economic shocks.

Dynamic Nature of the Economy:

Macroeconomic equilibrium models often assume static conditions. In reality, the economy is dynamic, subject to constant changes in technology, consumer preferences, and global events. Static models may struggle to capture the evolving nature of economic systems.

Limited Predictive Power:

Macroeconomic models based on historical data may struggle to predict or incorporate unforeseen events, such as financial crises, natural disasters, or global pandemics. These unexpected shocks can disrupt equilibrium and challenge the effectiveness of policy responses.

Imperfect Information:

Perfect information, a common assumption in macroeconomic equilibrium models, often does not align with the reality of information asymmetry. Participants in the economy may not have access to complete and accurate information, impacting decision-making and market outcomes.

Behavioral Economics Factors:

Macroeconomic equilibrium models may not fully account for behavioral economics factors, such as irrational decision-making, cognitive biases, or emotional responses, which can significantly influence economic outcomes.

Global Interdependencies:

In an interconnected world, national economies are highly interdependent. Macroeconomic equilibrium models that focus on individual nations may not adequately capture the global repercussions of economic policies or shocks.

Environmental Externalities:

Traditional macroeconomic models may not fully incorporate the environmental externalities associated with economic activities. Ignoring ecological impacts can lead to an incomplete understanding of sustainability and long-term economic well-being.

Distributional Implications:

Macroeconomic equilibrium models often do not explicitly address income distribution. Ignoring distributional implications may lead to policies that benefit some segments of the population more than others, exacerbating issues of income inequality.

Policy Endogeneity:

Macroeconomic policies can have endogenous effects, influencing variables they seek to stabilize. The concept of equilibrium may not adequately capture the complex feedback loops and unintended consequences that can arise from policy interventions.

Recognizing these limitations underscores the need for a nuanced and adaptive approach to economic analysis. Policymakers and economists must continually refine models, considering a broader array of factors and embracing the inherent complexity of economic systems. Macroeconomic equilibrium remains a valuable framework, but its application requires a constant awareness of its inherent constraints.

Macroeconomic Equilibrium in Different Economic Models

Macroeconomic equilibrium, a cornerstone of economic analysis, is conceptualized and analyzed through various economic models. Each model provides a unique perspective, capturing different facets of the complex interactions within an economy. Let’s explore how macroeconomic equilibrium is understood and modeled in key economic frameworks:

Classical Economic Model:

Key Features:

- Emphasizes the self-regulating nature of markets

- Assumes wage and price flexibility

- Stresses the importance of long-run equilibrium

Macroeconomic Equilibrium:

- Achieved when aggregate demand equals aggregate supply

- Prices and wages adjust freely to clear markets

- No involuntary unemployment in the long run

Implications:

- Limited role for government intervention

- Markets efficiently allocate resources

Keynesian Economic Model:

Key Features:

- Focuses on short-run dynamics and involuntary unemployment

- Argues for the role of government intervention in managing demand

- Highlights the importance of sticky wages and prices

Macroeconomic Equilibrium:

- Occurs when aggregate demand equals aggregate supply

- Prices and wages are not perfectly flexible

- Involuntary unemployment can persist in the short run

Implications:

- Advocates for countercyclical fiscal policies

- Supports government intervention to stabilize the economy

Neoclassical Synthesis:

Key Features:

- Integrates elements of both classical and Keynesian economics

- Acknowledges the importance of market forces and government intervention

- Recognizes short-run and long-run considerations

Macroeconomic Equilibrium:

- Balances the self-adjusting features of markets with the need for occasional government intervention

- Prices and wages adjust, but government policies are needed during economic downturns

Implications:

- Supports a mixed economy with a role for both markets and government

Monetarist Model:

Key Features:

- Emphasizes the role of money supply in determining economic outcomes

- Advocates for stable and predictable monetary policy

- Argues that fluctuations in money supply impact aggregate demand

Macroeconomic Equilibrium:

- Achieved when the money supply grows at a steady rate

- Prices and wages adjust to changes in money supply

- Inflation is primarily a monetary phenomenon

Implications:

- Calls for a rules-based monetary policy to maintain price stability

New Keynesian Model:

Key Features:

- Builds on Keynesian principles with a focus on microeconomic foundations

- Incorporates imperfect information and price rigidities

- Examines how individuals form expectations and adjust to new information

Macroeconomic Equilibrium:

- Analyzes how nominal rigidities and information asymmetry impact equilibrium.

- Prices and wages may be sticky, leading to short-run fluctuations.

Implications:

- Supports countercyclical policies to address short-run economic challenges

- Considers the impact of expectations on economic behavior

Real Business Cycle (RBC) Model:

Key Features:

- Focuses on real shocks and productivity changes

- Stresses the importance of technology and supply-side factors

- Assumes markets are always in equilibrium

Macroeconomic Equilibrium:

- Characterized by the efficient allocation of resources

- Fluctuations are driven by real shocks

- No role for countercyclical policies in the RBC framework

Implications:

- Emphasizes the importance of long-run growth and productivity

Understanding macroeconomic equilibrium in these diverse models highlights the richness of economic thought. Each model provides valuable insights into different aspects of economic behavior and policy implications, contributing to a comprehensive understanding of macroeconomic dynamics. The choice of model often depends on the specific context and questions being addressed.

Macroeconomic Equilibrium vs. Disequilibrium

Macroeconomic equilibrium and disequilibrium are crucial concepts in understanding the overall balance or imbalance within an economy. Let’s jump into the details of these terms and explore the factors that contribute to either a state of equilibrium or disequilibrium.

Macroeconomic Equilibrium:

Macroeconomic equilibrium refers to a situation where the aggregate demand (AD) for goods and services in an economy equals the aggregate supply (AS). In other words, the quantity of goods and services demanded by households, businesses, government, and foreign buyers matches the quantity supplied by producers. This state of equilibrium occurs at a specific price level and level of real GDP.

Characteristics:

- Quantity Demanded Equals Quantity Supplied: Equilibrium is achieved when the total quantity of goods and services demanded equals the total quantity supplied, leading to a stable state in the economy.

- Stable Price Level: The price level at which equilibrium occurs remains relatively stable, as there is no inherent tendency for prices to rise or fall in the aggregate.

- Full Employment: In an ideal state of equilibrium, the economy operates at full employment, utilizing all available resources efficiently.

Factors Influencing Equilibrium:

- Adjustments in price levels

- Changes in consumer and business confidence

- Government fiscal and monetary policies

- External factors like international trade conditions

Macroeconomic Disequilibrium:

Macroeconomic disequilibrium occurs when the aggregate demand does not equal the aggregate supply in the economy. This imbalance leads to shortages or surpluses in the market, creating pressures that drive adjustments in prices and quantities.

Characteristics:

- Shortages or Surpluses: Disequilibrium results in either excess demand (shortages) or excess supply (surpluses) of goods and services in the market.

- Price Adjustments: Prices tend to adjust to restore equilibrium. In the case of excess demand, prices may rise, while excess supply could lead to price decreases.

- Unemployment or Underutilization: Disequilibrium may result in unemployment or underutilization of resources, indicating inefficiencies in the allocation of factors of production.

Factors Contributing to Disequilibrium:

- Sudden shifts in consumer preferences.

- Unanticipated changes in government policies

- External shocks impacting international trade

- Technological disruptions affecting production

Policymakers often intervene to address disequilibrium through fiscal and monetary measures. For example, increasing government spending during a recession or adjusting interest rates to stimulate or cool economic activity.

Macroeconomic equilibrium is a desirable state, reflecting a balanced economy with stable prices and optimal resource utilization. Disequilibrium signals imbalances that necessitate adjustments to restore stability. Understanding these concepts is essential for policymakers, economists, and businesses seeking to navigate and influence economic conditions.

Macroeconomic Equilibrium | Definition | Graph | Table | Components | Factors | Limitations | Models | PDF Free Download |

Conclusion

Macroeconomics equilibrium is not merely a theoretical construct. It is the linchpin of economic stability. Its significance reverberates in the policy decisions of governments, the strategies of businesses, and the aspirations of individuals. As we bid adieu to the intricacies of equilibrium, we carry forth a heightened awareness of its role in shaping the destiny of economies, laying the foundation for a future marked by resilience and prosperity.