Welfare economics, a vital branch of economic theory, talk about the allocation of resources and goods within an economy. Its primary goal is to maximize societal well-being or welfare by evaluating economic outcomes in terms of both efficiency and equity.

In this post, we’ll explore what is welfare economics, the fundamental theorem, types, assumptions, limitations, concepts, and applications of welfare economics.

See Also: Definition of Economics | What is Economics

Table of Contents

ToggleWhat is Welfare Economics | Different Definitions

A branch of economics that focuses on the well-being of individuals and society as a whole. It aims to assess and improve societal welfare through the analysis of economic policies and their impact on individuals’ welfare. Various economists and scholars have provided different definitions and perspectives on welfare economics. Here are some of them.

-

Arthur Pigou’s Welfare Economics:

Arthur Pigou, another influential economist, introduced the concept of externalities and argued that welfare economics should focus on the divergence between private and social costs. He emphasized the need for government intervention to correct market failures and promote social welfare.

-

Lionel Robbins’ View:

Lionel Robbins, in his book “An Essay on the Nature and Significance of Economic Science,” emphasized that economics should be concerned with the allocation of scarce resources to satisfy unlimited human wants. While not explicitly focused on welfare, his work laid the foundation for modern economic analysis.

-

Paul Samuelson’s Definition:

Paul Samuelson, a Nobel laureate in economics, defined economics as “the study of how people produce, distribute, and consume wealth.” His work contributed to the development of welfare economics by incorporating consumer and producer surplus into economic analysis.

-

Knut Wicksell’s Contribution:

Knut Wicksell, a Swedish economist, made significant contributions to welfare economics. He introduced the concept of a “just” or “optimal” tax system that would maximize social welfare while considering both efficiency and equity.

-

Richard Musgrave’s Three Branches of Welfare Economics:

Richard Musgrave, an economist known for his work on public finance, divided welfare economics into three branches: allocation (efficiency), distribution (equity), and stabilization (macroeconomic stability). This division reflects the multifaceted nature of welfare economics.

-

Amartya Sen’s Capability Approach:

Amartya Sen, a Nobel laureate, introduced the capability approach to welfare economics. He argued that well-being should be assessed not only in terms of income but also in terms of individuals’ capabilities and freedoms to lead meaningful lives. This approach emphasizes the importance of social and political factors in enhancing welfare.

-

Modern Definitions:

In contemporary economics, welfare economics is often defined as the study of how economic policies and resource allocations affect the well-being of individuals and society. It involves evaluating policies based on their impact on utility, efficiency, and equity.

Normative vs. Positive Welfare Economics:

Welfare economics can be divided into normative and positive branches. Normative welfare economics focuses on making value judgments about policies to improve societal welfare. Positive welfare economics aims to analyze and understand economic phenomena without necessarily making normative judgments.

These definitions reflect the evolution of welfare economics over time and the diverse perspectives of economists. Welfare economics continues to be a dynamic field that seeks to address complex economic and ethical questions related to human well-being and societal progress.

The Fundamental Theorems of Welfare Economics

Welfare economics, a vital branch of economic theory, aims to study how resources are allocated in an economy to maximize societal well-being or “welfare.” Two fundamental theorems of welfare economics, known as the First Welfare Theorem and the Second Welfare Theorem, provide insights into how competitive markets can lead to optimal outcomes. Let’s discuss the five fundamental theorems of Welfare Economics in Detail

-

The First Welfare Theorem

The First Welfare Theorem, also referred to as the “Invisible Hand Theorem,” postulates that competitive markets result in a state of Pareto efficiency. Named after the Italian economist Vilfredo Pareto, Pareto efficiency occurs when resources are allocated in a way that no individual can be made better off without making someone else worse off. In essence, it represents an optimal allocation of resources.

Key points of the First Welfare Theorem:

- Competitive Markets: This theorem assumes perfectly competitive markets where there is free entry and exit, perfect information, and no externalities (spillover effects on third parties).

- Consumer Sovereignty: It implies that consumers are the ultimate decision-makers. They express their preferences through demand, which, in turn, guides producers in allocating resources efficiently.

- No Wasted Resources: Pareto efficiency ensures that resources are allocated such that there is no waste, meaning society is getting the maximum possible benefit from its resources.

- No Externalities: Externalities, which are costs or benefits imposed on third parties not involved in a transaction, are assumed to be absent. This simplifies the analysis but is a significant limitation in real-world scenarios.

While the First Welfare Theorem provides valuable insights into the potential efficiency of competitive markets, it relies on a set of idealized assumptions that are rarely met in reality. The presence of market imperfections, information asymmetry, and externalities often prevents the realization of Pareto efficiency.

-

The Second Welfare Theorem

The Second Welfare Theorem builds upon the insights of the First Welfare Theorem and addresses the limitations of the real world. It states that any Pareto-efficient allocation can be reached through redistributing initial endowments of resources.

Key points of the Second Welfare Theorem:

- Initial Endowments: The theorem acknowledges that initial resource endowments might not result in a Pareto-efficient allocation. Some individuals or groups may hold more resources than others, leading to potential inefficiencies.

- Redistribution: To achieve Pareto efficiency, the theorem suggests that redistributions, such as taxes and transfers, can be implemented. These redistributions alter the initial allocations of resources to ensure that everyone is at least as well off as in their initial state.

- Compensation: A crucial aspect of the Second Welfare Theorem is the notion of compensation. It implies that individuals or groups who lose from the redistribution should be compensated to ensure their consent and willingness to accept the new allocation.

- Challenges in Practice: While theoretically sound, the practical implementation of the Second Welfare Theorem faces challenges related to defining fair compensation, the feasibility of redistributions, and the existence of political and social constraints.

-

The Third Fundamental Theorem of Welfare Economics

The Third Fundamental Theorem focuses on the conditions necessary to achieve Pareto efficiency, emphasizing that individuals should be allowed to exchange resources freely, provided they agree to the terms voluntarily.

It states that any initial allocation of resources can be transformed into a Pareto-efficient allocation through competitive market exchanges. However, this theorem assumes that markets are competitive, and participants have perfect information, which might not hold in reality.

-

The Fourth Fundamental Theorem of Welfare Economics

The Fourth Fundamental Theorem introduces the concept of public goods and the role of government. It recognizes that public goods, which are non-excludable and non-rivalrous (like clean air or national defense), cannot be efficiently provided by the market due to free-rider problems.

Therefore, government intervention is required to provide public goods efficiently. This theorem underscores the importance of a well-functioning government in addressing market failures.

-

The Zeroth Fundamental Theorem of Welfare Economics

The Zeroth Fundamental Theorem states that, under certain conditions, a competitive equilibrium is Pareto efficient.

In other words, when markets are perfectly competitive, with no externalities (spillover effects on third parties) and complete information, the allocation of resources reaches a state where no one can be made better off without making someone else worse off. This concept is the basis for analyzing the efficiency of markets and is foundational for the subsequent theorems.

Types of Economic Efficiency

Economic efficiency refers to the allocation of resources that maximizes the overall benefit to society. It can be categorized into three main types: allocative efficiency, productive efficiency, and dynamic efficiency. Let’s explain each of these types in detail:

-

Allocative Efficiency:

Allocative efficiency occurs when resources are distributed in a way that maximizes overall societal welfare. In other words, it’s the point at which the allocation of goods and services matches the preferences and demands of consumers. Key characteristics of allocative efficiency include:

Marginal Benefit Equals Marginal Cost: Allocative efficiency is achieved when the marginal benefit (the additional satisfaction or utility a consumer receives from consuming one more unit of a good) equals the marginal cost (the additional cost of producing one more unit of a good). At this equilibrium point, society gets the most value from its resources because no one can be made better off without making someone else worse off.

No Deadweight Loss: In an allocatively efficient market, there is no deadweight loss, which represents a reduction in total welfare due to market imperfections like taxes or monopolies. Allocative efficiency minimizes deadweight loss by ensuring that transactions occur at the equilibrium price and quantity.

-

Productive Efficiency:

Productive efficiency focuses on the production side of the economy. It occurs when goods and services are produced at the lowest possible cost while maintaining quality standards. Key characteristics of productive efficiency include:

Cost Minimization: Productive efficiency is achieved when firms produce goods and services using the fewest possible resources. This means that inputs (e.g., labor, capital, and raw materials) are used efficiently, resulting in cost minimization.

Full Utilization of Resources: Productive efficiency implies that resources are fully employed in the production process. There is no wastage or underutilization of inputs, and firms operate at their production possibility frontier (PPF), which represents the maximum output attainable with given resources.

-

Dynamic Efficiency:

Dynamic efficiency focuses on the ability of an economy to adapt, innovate, and grow over time. It involves continuous improvement in production methods, technology, and the quality of goods and services. Key characteristics of dynamic efficiency include:

- Innovation: Dynamic efficiency is driven by innovation and technological progress. Firms invest in research and development to create new products, improve existing ones, and find more efficient production techniques.

- Market Competition: Competitive markets often promote dynamic efficiency by incentivizing firms to innovate and stay ahead of their competitors. The threat of competition encourages firms to adopt new technologies and practices.

- Long-Term Growth: Economies that prioritize dynamic efficiency experience long-term economic growth and increased living standards. Innovation and technological advancements drive productivity gains and higher levels of output.

It’s important to note that achieving all three types of economic efficiency simultaneously can be challenging. Trade-offs may exist between allocative and productive efficiency, and dynamic efficiency often requires short-term sacrifices for long-term gains. Moreover, real-world markets are rarely perfectly efficient due to various market imperfections and external factors.

Economists and policymakers aim to strike a balance between these types of efficiency to ensure that the economy operates optimally, provides goods and services that meet society’s needs, and fosters innovation and growth over time.

Pareto Efficiency vs. Kaldor-Hicks Efficiency

Pareto Efficiency and Kaldor-Hicks Efficiency are two concepts used in economics to assess the efficiency of resource allocations and policy changes. While both are concerned with improving societal welfare, they have distinct criteria and implications. Let’s explore each in detail:

Pareto Efficiency (Optimality):

Pareto Efficiency, also known as Pareto Optimality, is a situation in which resources are allocated so that no one can be made better off without making someone else worse off. In other words, it represents an allocation where it is impossible to make one person better off without hurting another person.

Criteria: Pareto Efficiency is based on the concept of Pareto Improvement. An allocation is Pareto Efficient if there are no Pareto Improvements possible. A Pareto Improvement occurs when at least one individual becomes better off (or remains at the same level of satisfaction) without making anyone else worse off.

Key Characteristics:

- Pareto Efficiency focuses on the absence of any potential improvements that would benefit at least one person without harming others.

- It is considered a strong criterion for efficiency since it implies that resources are allocated in the best possible way given the initial distribution.

Implications:

- Pareto Efficiency is often used as a benchmark for evaluating economic situations, policies, or resource allocations.

- If a policy change or resource allocation leads to a Pareto Improvement, it is considered socially desirable.

Kaldor-Hicks Efficiency (Potential Optimality):

Kaldor-Hicks Efficiency is a broader concept that assesses the potential for improving societal welfare by allowing some individuals to gain while compensating others for their losses.

Unlike Pareto Efficiency, it permits situations where some people may be worse off as long as the gains of winners exceed the losses of losers when compensation is possible.

Criteria: In a Kaldor-Hick’s improvement, those who benefit from a change could, in principle, compensate those who are harmed, resulting in a net gain in societal welfare. It doesn’t require actual compensation but considers the potential for it.

Key Characteristics:

- Kaldor-Hicks Efficiency recognizes that not all resource reallocations or policy changes will lead to Pareto Improvements, but they may still enhance societal welfare if compensation mechanisms exist.

Implications

- Policies that lead to Kaldor-Hick’s improvements are often seen as potentially beneficial, even if they do not meet the strict criteria of Pareto Efficiency.

- Compensation mechanisms, such as taxes and subsidies, can be used to ensure that those who benefit from a change compensate those who are worse off, thus making the change Kaldor-Hicks efficient.

Comparison:

- Pareto Efficiency is a stronger and more restrictive criterion, as it requires that no one can be made worse off without making someone else better off.

- Kaldor-Hicks Efficiency is a more flexible criterion that considers the potential for compensation, allowing for situations where some may lose as long as the gains of others are sufficient to compensate for the losses.

Both Pareto Efficiency and Kaldor-Hicks Efficiency aim to assess the efficiency of resource allocations and policy changes, they differ in their criteria and implications.

Pareto Efficiency focuses on no one being made worse off, while Kaldor-Hicks Efficiency considers potential improvements and compensations to evaluate changes in societal welfare. Kaldor-Hicks Efficiency provides a broader framework for assessing policies that may involve trade-offs between winners and losers.

See Also: What is Consumer Surplus | How to Calculate It | Graph | Factors | Limitations

Measuring Welfare Changes: Consumer Surplus and Producer Surplus

Measuring welfare changes in economics often involves the use of two key concepts: Consumer Surplus and Producer Surplus.

These concepts help economists and policymakers assess the impact of changes in markets, such as shifts in supply and demand, taxation, or price regulations, on the welfare of consumers and producers. Let’s discuss these concepts in detail:

Consumer Surplus:

Consumer Surplus represents the economic benefit or utility that consumers receive when they are able to purchase a product at a price lower than the maximum price, they are willing to pay. It measures the difference between what consumers are willing to pay (their reservation price) and what they actually pay for a good or service.

Formula: Consumer Surplus (CS) can be calculated as follows:

CS = Total Willingness to Pay – Total Actual Expenditure

Graphical Representation: On a supply and demand graph, consumer surplus is represented as the area between the demand curve and the market price, up to the quantity purchased. It is the triangular area above the market price and below the demand curve.

Interpretation: Consumer Surplus reflects the additional value that consumers gain from transactions in a market. A higher consumer surplus indicates that consumers are benefiting more from the market, while a lower consumer surplus suggests reduced consumer welfare.

Producer Surplus:

Producer Surplus is the economic benefit or profit that producers receive when they can sell their goods or services at a price higher than the minimum price at which they are willing to supply the product. It represents the difference between the actual selling price and the minimum acceptable price for producers.

Formula: Producer Surplus (PS) can be calculated as follows:

PS = Total Revenue – Total Opportunity Cost

Opportunity cost is the cost of resources used in production, including both explicit costs (e.g., labor, materials) and implicit costs (e.g., forgone opportunities).

Graphical Representation: On a supply and demand graph, producer surplus is represented as the area between the supply curve and the market price, up to the quantity sold. It is the triangular area below the market price and above the supply curve.

Interpretation: Producer Surplus indicates the additional profit that producers earn from transactions in a market. A higher producer surplus implies that producers benefit more from the market, while a lower producer surplus suggests reduced producer welfare.

Measuring Welfare Changes:

- Market Equilibrium: In a perfectly competitive market, where supply and demand intersect (market equilibrium), both consumer and producer surplus are maximized, and the allocation of resources is considered efficient.

- Welfare Analysis: Changes in market conditions, such as shifts in supply or demand, taxes, subsidies, or price controls, can lead to alterations in consumer and producer surpluses. Welfare analysis assesses the net impact of these changes on overall societal welfare.

- Efficiency and Deadweight Loss: Economists use consumer and producer surplus to evaluate whether markets are operating efficiently or if there is a deadweight loss (reduction in welfare) due to factors like taxes or price ceilings.

Consumer Surplus and Producer Surplus are essential concepts in welfare economics used to quantify the benefits gained by consumers and producers in a market. Understanding these surpluses helps policymakers and economists make informed decisions about market interventions and regulatory measures.

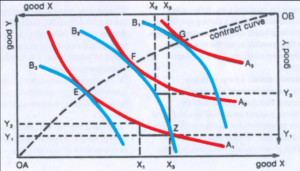

The Edgeworth Box Diagram

The Edgeworth Box Diagram, also known as the Edgeworth-Bowley Box, is a graphical representation used in microeconomics to illustrate the distribution of goods and resources between two individuals in an exchange economy.

It was developed by economists Francis Ysidro Edgeworth and Alfred Marshall. This diagram is particularly useful for understanding the concepts of Pareto efficiency and trade.

Key Components of the Edgeworth Box Diagram:

- Box:

The diagram consists of a rectangular box, which represents the total resources available in the economy. The two vertical sides of the box represent the quantities of two different goods, often labeled as “X” and “Y.” The horizontal axis, running through the center of the box, represents the total quantity of both goods.

- Initial Endowments:

Each individual is assigned an initial endowment of goods. These endowments are represented as points within the box. For example, if individual A has 5 units of good X and 3 units of good Y, their initial endowment is denoted as point A (5,3) within the box. Similarly, individual B’s initial endowment might be represented as point B (2,6).

- Contract Curve:

The contract curve is a locus of points within the box where individuals could potentially trade or exchange goods to improve their well-being. Points along the contract curve represent allocations of goods that are Pareto efficient, meaning that no individual can be made better off without making someone else worse off.

- Indifference Curves:

Indifference curves for each individual are typically drawn on the diagram. These curves represent combinations of goods that provide the same level of utility or satisfaction to each individual. They are used to identify the preferences and trade-offs each individual faces.

See Also: Edgeworth Box | Concepts | Diagram | Limitations | Assumptions | Examples

Understanding the Edgeworth Box Diagram:

The Edgeworth Box Diagram helps illustrate the following concepts:

- Pareto Efficiency: Points along the contract curve represent Pareto efficient allocations. These are situations where no further trade between individuals can occur without making one of them worse off. Pareto efficiency signifies an allocation of resources where resources are fully utilized and no waste occurs.

- Initial Endowments: The initial endowment points represent the starting point for individuals. These points can be inside or outside the contract curve, indicating whether resources are distributed efficiently or not.

- Gains from Trade: As individuals move from their initial endowment points towards the contract curve, they can achieve mutual gains from trade. This demonstrates how voluntary exchanges can lead to a more efficient allocation of resources.

- Distribution of Goods: The diagram provides insights into how goods are distributed between individuals in a market. It helps answer questions about the fairness of resource allocation.

- Consumer Preferences: The indifference curves help depict each individual’s preferences and the trade-offs they are willing to make between goods X and Y.

The Edgeworth Box Diagram is a powerful tool for analyzing the allocation of resources, trade, and Pareto efficiency in exchange economies involving two individuals and two goods. It provides a visual representation of how resources can be allocated to achieve mutually beneficial outcomes and is a fundamental concept in microeconomic theory.

See Also: Cost and Benefit Analysis | Concepts | Steps | Types | Examples | Challenges

Cost-Benefit Analysis in Welfare Economics

Cost-Benefit Analysis (CBA) is a crucial tool in the field of welfare economics and public policy evaluation. It is a systematic approach used to assess the desirability of a project, program, or policy by comparing the total costs involved with the total benefits expected to be generated.

CBA plays a pivotal role in decision-making processes for governments, organizations, and policymakers as it helps determine whether a proposed action is economically efficient and socially beneficial. Let’s explain Cost-Benefit Analysis in welfare economics in detail below.

-

Identification of the Project or Policy

The first step in CBA is to identify the project, program, or policy under consideration. This could be anything from building a new infrastructure project, implementing a public health program, or enacting environmental regulations.

-

Identifying Costs and Benefits:

Once the project is defined, a comprehensive list of all associated costs and benefits is compiled. Costs include both initial expenditures (e.g., construction costs, implementation costs) and ongoing operational and maintenance costs. Benefits encompass the positive outcomes, which can be both monetary and non-monetary, that result from the project (e.g., increased revenue, improved public health, reduced pollution).

-

Valuation of Costs and Benefits:

Assigning monetary values to costs and benefits is a critical step in CBA. While some costs and benefits are straightforward to monetize (e.g., construction expenses), others may require more complex techniques, such as willingness-to-pay surveys or market pricing, to estimate their economic value.

-

Time Discounting

CBA considers the time value of money, recognizing that a dollar received today is worth more than a dollar received in the future. Therefore, future costs and benefits are typically discounted back to their present values using an appropriate discount rate.

-

Comparison:

The present value of total costs is compared to the present value of total benefits to calculate the net present value (NPV). If NPV is positive, it indicates that the benefits outweigh the costs, suggesting the project is economically viable and should be considered for implementation. Conversely, a negative NPV suggests that the project may not be justified from an economic perspective.

-

Sensitivity Analysis:

Since CBA often involves uncertainties, sensitivity analysis is conducted to assess the impact of variations in cost and benefit estimates, discount rates, or other factors on the results. This helps decision-makers understand the robustness of the analysis.

-

Decision-Making:

Based on the results of the CBA, policymakers and stakeholders can make informed decisions about whether to proceed with the project or policy. A positive NPV indicates that the benefits exceed the costs, providing a strong economic rationale for implementation.

-

Ethical Considerations:

While CBA provides valuable economic insights, it may not capture all ethical or distributional concerns. Decision-makers should also consider equity, fairness, and ethical implications when evaluating projects or policies.

Advantages of Cost-Benefit Analysis:

- Objective Decision-Making: CBA offers an objective framework for evaluating projects, helping decision-makers prioritize projects that provide the greatest overall societal benefit.

- Comprehensive Assessment: It considers both economic and non-economic factors, leading to a more comprehensive understanding of the implications of a project.

- Resource Allocation: CBA assists in allocating resources efficiently, ensuring that limited resources are directed toward projects with the highest net benefits.

Limitations of Cost-Benefit Analysis:

- Subjectivity: The process of valuing costs and benefits can be subjective, leading to potential biases in the analysis.

- Difficulty in Valuing Non-Market Goods: Assigning monetary values to non-market goods (e.g., clean air, public safety) can be challenging.

- Ethical Concerns: CBA may not fully address ethical and distributional concerns, potentially leading to inequitable outcomes.

Cost-Benefit Analysis is a valuable tool for evaluating the economic efficiency and desirability of projects and policies. While it provides a systematic approach to decision-making, it should be complemented by ethical considerations and a broader societal perspective to ensure the well-being of all stakeholders.

Equity vs. Efficiency in Welfare Economics

Equity and efficiency are two fundamental concepts in the field of welfare economics, and they represent different aspects of societal well-being and resource allocation. While they are related, they often come into conflict, and policymakers must strike a balance between them when designing economic policies. Let’s explain both equity and efficiency in detail and discuss their trade-offs.

Efficiency:

Efficiency in welfare economics refers to the optimal allocation of resources to maximize overall societal well-being. It involves achieving the highest possible level of total economic output or utility (satisfaction) with the given resources. Efficiency is typically measured by assessing whether resources are allocated in a way that minimizes waste and maximizes the net benefits to society.

Key points related to Efficiency:

- Pareto Efficiency: A situation is considered Pareto efficient when it is impossible to make one person better off without making someone else worse off. In other words, resources are allocated in a way that no one can be made better off without harming someone else. Pareto efficiency is often used as a benchmark for economic efficiency.

- Productive Efficiency: Productive efficiency occurs when goods and services are produced at the lowest possible cost, given existing technology and resources. This minimizes waste and ensures that society gets the most output from its resources.

- Allocative Efficiency: Allocative efficiency is achieved when resources are distributed among various goods and services in a way that reflects consumer preferences. In other words, the quantity of each good produced matches the quantity that consumers are willing to buy at the market price.

Equity:

Equity, on the other hand, focuses on fairness and justice in the distribution of resources and benefits within a society. It is concerned with whether the benefits and burdens of economic activities are distributed in a way that is considered morally or socially just. Equity considerations often lead to policies aimed at reducing income and wealth inequality.

Key points related to Equity:

- Income Distribution: Equity often involves addressing income inequality. Policymakers may implement progressive taxation, minimum wage laws, or social safety nets to redistribute income from the wealthy to the less fortunate.

- Access to Opportunities: Equity also encompasses providing equal access to opportunities, such as education, healthcare, and employment. Policies that promote equal access aim to level the playing field for all members of society.

- Redistribution: Equity may require the redistribution of resources and wealth to ensure that disadvantaged groups have a better standard of living and access to essential services.

Trade-offs between Equity and Efficiency:

There is often a trade-off between equity and efficiency in policymaking. Policies that increase equity, such as progressive taxation or minimum wage laws, may reduce economic efficiency by distorting incentives, reducing work effort, or impeding resource allocation. Conversely, policies aimed at maximizing efficiency, such as deregulation or reducing taxes on capital, may exacerbate income inequality.

Balancing these two objectives is challenging. Policymakers must consider the societal values and priorities of their constituents, the specific economic context, and the potential consequences of their decisions. Striking the right balance between equity and efficiency requires careful analysis and often involves making difficult choices.

Equity and efficiency represent two core objectives in welfare economics. Efficiency aims to maximize overall societal well-being through optimal resource allocation, while equity focuses on achieving fairness and justice in the distribution of resources and benefits. Policymakers face trade-offs between these objectives and must carefully consider their policy choices in light of these competing goals.

See Also: Economics is a Science as Well as an Art | Explain

Assumptions of Welfare Economics

Welfare economics, as a branch of economics, operates under certain key assumptions that provide the foundation for its analysis of economic well-being and policy evaluation. These assumptions help simplify complex real-world situations and provide a framework for making normative judgments about societal welfare. Here are the fundamental assumptions of welfare economics:

-

Individual Rationality:

Assumption: Individuals are assumed to be rational decision-makers who act in their own best interests.

This assumption simplifies the analysis by considering individuals as utility-maximizers. It forms the basis for assessing welfare changes based on individual preferences and choices.

-

Utility Maximization:

Assumption: Individuals seek to maximize their utility or well-being.

Utility represents a measure of satisfaction or happiness, and individuals are assumed to make choices that maximize their overall utility. This assumption underlies the analysis of consumer and producer behavior.

-

Preferences:

Assumption: Individuals have well-defined and transitive preferences.

Preferences are assumed to be consistent and capable of being ranked. This assumption allows for the measurement and comparison of individual and societal well-being.

-

Pareto Efficiency:

Assumption: Pareto efficiency represents an ideal state in which no individual can be made better off without making someone else worse off.

Welfare economics often uses Pareto efficiency as a benchmark for evaluating policy changes. This assumption reflects the notion that improvements in societal welfare should not come at the expense of others.

-

Competitive Markets:

Assumption: Competitive markets allocate resources efficiently.

Welfare economics frequently assumes perfectly competitive markets as a benchmark for efficiency. This simplifies the analysis and provides a reference point for evaluating market outcomes.

-

No Externalities:

Assumption: Markets do not involve externalities, such as pollution or spillover effects.

The absence of externalities simplifies the analysis of market outcomes. When externalities exist, they can lead to market failures and deviations from efficiency.

-

Perfect Information:

Assumption: Individuals have access to perfect information and make decisions based on complete knowledge.

Perfect information simplifies the analysis but may not reflect real-world conditions where information is often imperfect or asymmetric.

-

Fixed Preferences:

Assumption: Individual preferences remain fixed over time.

This assumption simplifies analysis but may not capture changes in preferences, tastes, or expectations that occur in reality.

-

No Income Redistribution:

Assumption: Income redistribution, such as taxes and transfers, is not considered in the initial analysis.

Income redistribution policies, which are often a subject of welfare analysis, are excluded in the baseline analysis but can be incorporated to assess equity concerns.

-

No Market Power:

Assumption: Firms in markets do not possess significant market power or monopolistic control.

This assumption simplifies the analysis of competitive markets but may not apply in sectors with dominant firms or monopolistic behavior.

-

Social Welfare Function:

Assumption: There exists a social welfare function that aggregates individual utilities into a societal welfare measure.

This assumption provides a framework for combining individual well-being to make collective decisions. The choice of the social welfare function can influence policy outcomes.

-

No Income Effects:

Assumption: Changes in income do not affect individual preferences or utility.

This simplifies the analysis by isolating price and substitution effects from income effects.

These assumptions serve as foundational principles for welfare economics but may not always hold in practice. Real-world applications of welfare economics often relax some of these assumptions to address more complex and nuanced economic issues. Nonetheless, these assumptions provide a valuable framework for analyzing and evaluating policies aimed at enhancing societal well-being.

Criticisms and Limitations of Welfare Economics

Welfare economics, which aims to assess and improve societal well-being through economic policies, has received its fair share of criticisms and limitations. While it provides valuable insights into resource allocation and societal welfare, it also faces challenges and drawbacks. It’s time to explain some of the key criticisms and limitations of welfare economics:

-

Subjectivity and Value Judgments:

Critics argue that welfare economics often relies on subjective judgments and value assessments, making it susceptible to cultural and moral relativism. What one society considers “good” or “bad” may differ from another’s perspective.

The construction of a social welfare function, which aggregates individual utilities into a societal measure, is subject to significant value judgments. The choice of this function can significantly impact policy outcomes.

-

Incomplete Information:

In practice, individuals may not have perfect information about their own preferences or the consequences of their choices. Welfare economics assumes complete and accurate information, which may not align with real-world conditions.

People’s preferences and well-being can change over time, making it challenging to capture these changes accurately in economic models.

-

Arrow’s Impossibility Theorem:

Nobel laureate Kenneth Arrow’s theorem demonstrates that it is impossible to construct a social welfare function that satisfies all desirable properties simultaneously. This theorem challenges the feasibility of achieving a universally acceptable societal welfare measure.

-

Income Distribution and Inequality:

Traditional welfare economics often neglects income distribution concerns. Policies that maximize overall societal welfare may not address income inequality adequately.

Utilitarian approaches, such as Kaldor-Hick’s efficiency, may prioritize overall welfare improvements while ignoring the distributional consequences. This can lead to policies that benefit the majority at the expense of a minority.

-

Public Goods and Externalities:

Welfare economics struggles to address the provision of public goods like national defense, clean air, and public infrastructure, which are crucial for societal welfare but often undersupplied by the private sector.

It can be challenging to internalize externalities (spillover effects), such as pollution or healthcare benefits, in welfare calculations, leading to suboptimal resource allocation.

-

Dynamic and Interconnected Economies:

Welfare economics tends to focus on static analysis, often overlooking dynamic effects. Economic decisions can have far-reaching consequences that may not be apparent in short-term analyses.

Modern economies are highly interconnected, making it difficult to isolate the effects of a single policy change. Policies targeting one area can have unintended consequences in other sectors.

-

Equity-Efficiency Trade-offs:

The trade-off between equity and efficiency poses a fundamental challenge. Policies that enhance equity may reduce efficiency and vice versa, making it difficult to find an optimal balance.

-

Behavioral Economics Insights:

Behavioral economics has uncovered various cognitive biases and deviations from rational decision-making. Welfare economics models often assume rational behavior, which may not align with observed human behavior.

-

Political and Power Dynamics:

Political power dynamics and the influence of special interest groups can distort policy decisions away from the maximization of societal welfare.

Public choice theory suggests that regulatory agencies may be captured by the industries they are supposed to regulate, leading to policies that serve industry interests rather than societal welfare.

-

Non-economic Factors:

Welfare economics typically focuses on economic aspects of well-being while neglecting non-economic factors like social relationships, culture, and psychological factors that also influence overall welfare.

Welfare economics provides valuable tools for assessing and improving societal well-being, it is not without criticisms and limitations.

The subjectivity of value judgments, incomplete information, income distribution concerns, and the trade-offs between equity and efficiency are among the challenges that policymakers and economists must navigate when applying welfare economics in real-world contexts.

Addressing these limitations often requires a multidisciplinary approach that incorporates insights from various fields, including behavioral economics, political science, and sociology.

Applications of Welfare Economics in Public Policy

Welfare economics plays a crucial role in shaping public policy by providing a framework for assessing and optimizing societal well-being. Here are some of the key applications of welfare economics in public policy.

-

Cost-Benefit Analysis (CBA):

CBA is a fundamental tool in welfare economics used to evaluate the desirability of public projects and policies by comparing their costs and benefits.

Governments use CBA to assess the economic viability of infrastructure projects, environmental regulations, healthcare interventions, and other public investments. By quantifying the expected costs and benefits, policymakers can make informed decisions about project implementation.

-

Taxation and Redistribution:

Definition: Welfare economics helps analyze the impact of taxation and redistribution policies on income distribution and overall societal welfare.

Application: Policymakers use welfare economics to design tax systems that balance revenue generation with equity considerations. Progressive taxation, where higher-income individuals pay a higher percentage of their income in taxes, is an example of a policy informed by welfare economics.

-

Environmental Regulation:

Welfare economics aids in assessing and designing regulations aimed at addressing environmental externalities and promoting sustainable practices.

Governments use welfare economics to determine optimal pollution levels, set emissions standards, and design cap-and-trade systems. These policies aim to balance economic growth with environmental preservation, considering both short-term costs and long-term benefits.

-

Healthcare Policy:

Welfare economics informs healthcare policy decisions by assessing the allocation of healthcare resources and the trade-offs between healthcare quality, access, and costs.

Policymakers use welfare economics to evaluate healthcare systems, such as single-payer or multi-payer models, and to make decisions regarding insurance coverage, healthcare pricing, and resource allocation in the healthcare sector.

-

Education Policy:

Welfare economics helps assess the effectiveness of education policies in improving human capital and societal well-being.

Policymakers use welfare economics to evaluate education programs, school funding, and educational reforms. They consider factors like educational attainment, labor market outcomes, and the economic returns on education investments.

-

Antitrust and Competition Policy:

Welfare economics guides policymakers in promoting competition, preventing monopolistic behavior, and ensuring fair market competition.

Antitrust authorities use welfare economics to assess mergers and acquisitions, prevent anticompetitive practices, and regulate industries with significant market power. Policies aim to balance market efficiency with consumer welfare.

-

Social Safety Nets:

Welfare economics helps design and evaluate social safety net programs that provide assistance to vulnerable populations.

Governments use welfare economics to determine eligibility criteria, benefit levels, and the overall design of social programs like unemployment insurance, welfare assistance, and food aid. These programs aim to reduce poverty and improve the well-being of disadvantaged individuals and families.

-

Trade and Tariff Policies:

Welfare economics informs trade policies by assessing the impact of tariffs, trade agreements, and protectionist measures on domestic and global welfare.

Policymakers use welfare economics to analyze the effects of trade policies on domestic industries, consumer prices, and international trade balances. Trade agreements like NAFTA and the TPP incorporate welfare considerations.

-

Infrastructure Investment:

Welfare economics guides decisions related to infrastructure development, including transportation, energy, and telecommunications.

Governments use welfare economics to prioritize infrastructure projects that enhance economic productivity and improve quality of life. This includes assessing the cost-effectiveness of investments in roads, bridges, public transit, and broadband access.

-

Housing and Urban Planning:

Welfare economics informs housing and urban planning policies aimed at addressing housing affordability, urban sprawl, and equitable access to housing.

Policymakers use welfare economics to evaluate zoning regulations, rent control, housing subsidies, and urban development initiatives. These policies aim to balance housing market efficiency with housing affordability and equitable access.

Welfare economics serves as a valuable tool for policymakers to evaluate, design, and implement a wide range of public policies across various sectors. By considering the trade-offs between efficiency and equity, policymakers can make informed decisions that enhance societal well-being and improve the quality of life for their constituents.

See Also: What is the Nature & Scope of Economics

Conclusion

Welfare economics remains a cornerstone of economic analysis. It provides valuable insights into how economic choices impact societal welfare, helping policymakers strike a balance between efficiency and equity. As we navigate complex societal challenges, the principles of welfare economics continue to guide us toward a better understanding of our choices and their consequences.

Welfare Economics Explained | Definitions | Theorem | Types | Assumptions | Limitations | Free Download PDF |